Forte Minerals Corp. (‘Forte’ or the ‘Company’) (CSE: CUAU,OTC:FOMNF) (OTCQB: FOMNF) (Frankfurt: 2OA) a Canadian copper and gold exploration company focused on Peru, is pleased to announce that it will exhibit at the Prospectors & Developers Association of Canada (‘PDAC’) Convention 2026, taking place March 1–4, 2026 at the Metro Toronto Convention Centre in Toronto.

Visit Forte Minerals Corp at Booth 2736 in the Investors Exchange (South Building).

PDAC is the world’s premier mineral exploration and mining convention, attracting more than 27,000 participants from over 125 countries, including institutional investors, mining executives, government representatives, analysts, and technical professionals.

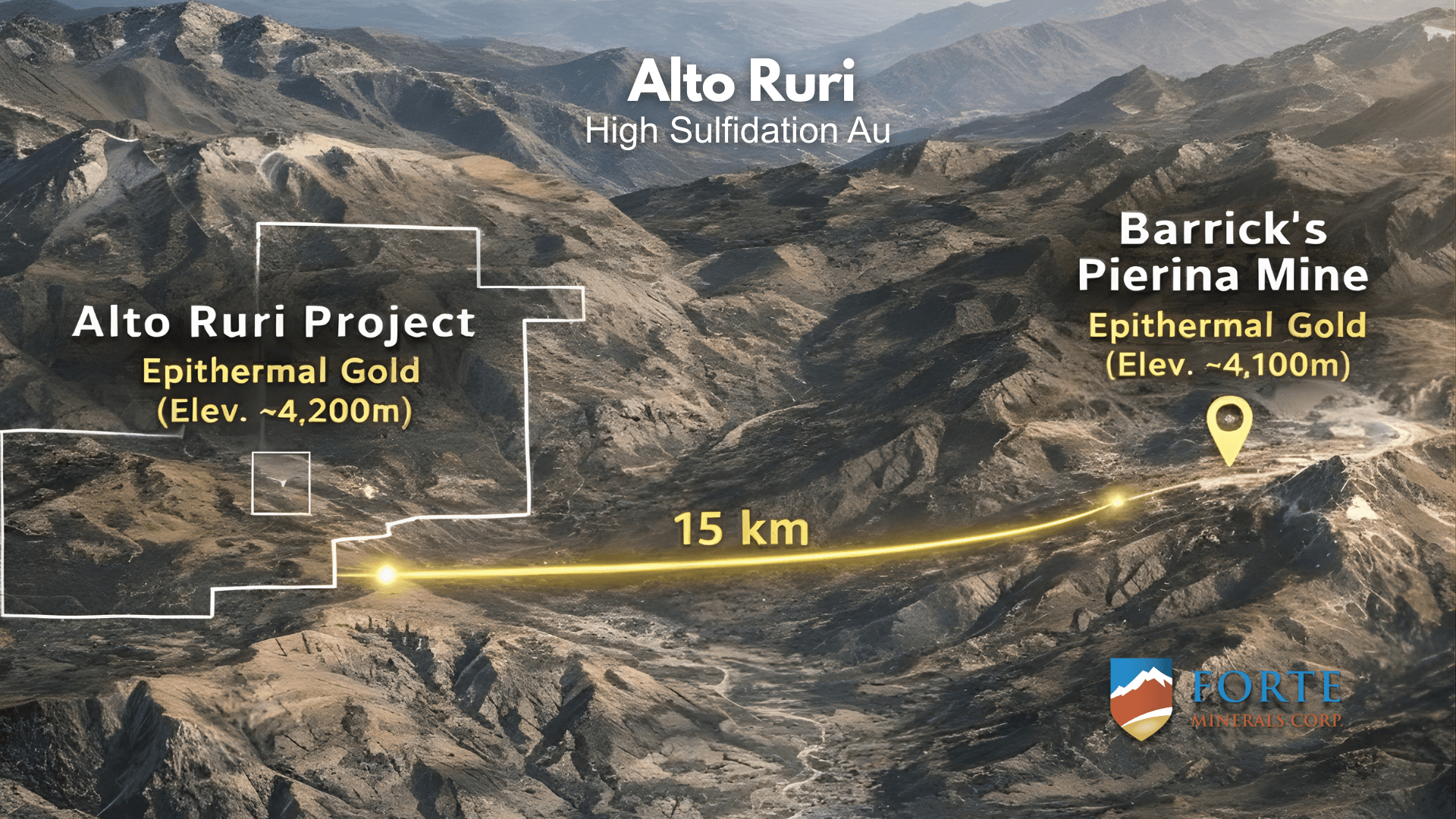

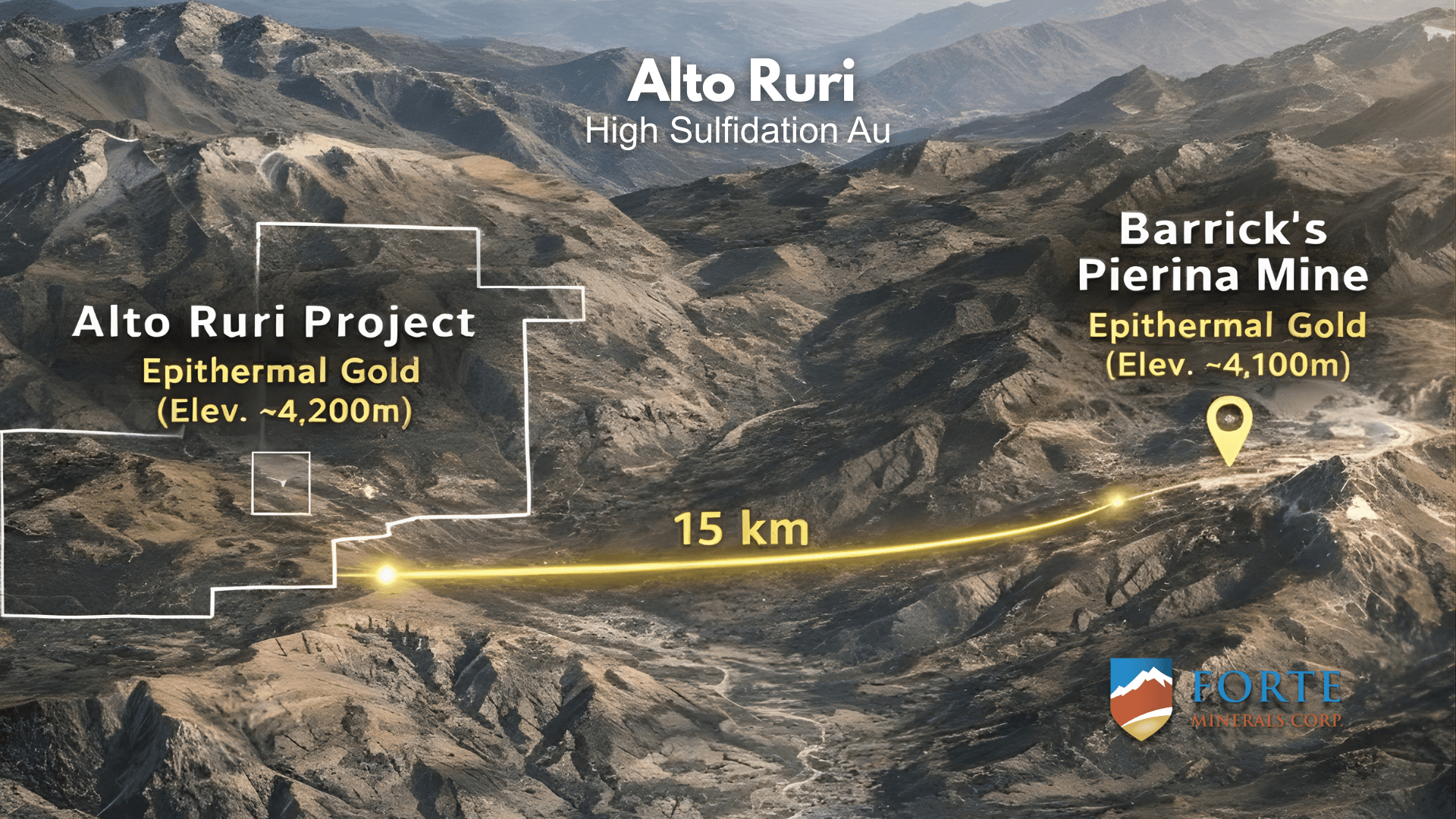

Alto Ruri Gold Project: High Sulfidation Epithermal System in Peru

The Alto Ruri Gold Project is located approximately 15 kilometres south of Barrick Gold’s Pierina Mine, which is currently in its closure and reclamation phase following more than two decades of production.

Pierina demonstrated the presence of a robust high-sulfidation epithermal gold system within Peru’s Cordillera Negra belt. Alto Ruri shares similar geological characteristics, including vuggy silica and advanced argillic alteration, supporting the potential for a preserved epithermal system within the same regional corridor.

The Alto Ruri Gold Project comprises approximately 4,700 hectares of wholly owned mineral concessions situated within Peru’s prolific Miocene Tertiary Volcanic Arc, host to multiple world-class gold and copper deposits.

Initial drilling by Compañía de Minas Buenaventura in 1997 included 12 shallow drill holes totaling 2,254.5 metres. (Refer to the Company’s news release – March 4th, 2024).

The most significant intercept from Hole 001-97 returned

- 131 metres grading 2.55 g/t gold from surface, including

- 54 metres grading 5.39 g/t gold

These results were re-assayed in 2011, confirming the presence of a well-developed high-sulfidation epithermal system associated with vuggy silica and advanced argillic alteration.

True widths remain undetermined, and modern confirmation drilling is planned as part of the Company’s systematic advancement strategy.

The Alto Ruri Gold Project represents a modern re-evaluation opportunity within a proven Andean gold district that has not undergone comprehensive exploration in nearly three decades.

Figure 1 The Alto Ruri Gold Project is located 15 kilometres south of Barrick’s Pierina Mine in Peru’s Cordillera Negra

Forte Minerals Leadership at PDAC 2026

Senior leadership from Forte Minerals Corp. will be present at Booth 2736 throughout PDAC 2026, including:

Patrick Elliott, MSc. MBA Chief Executive Officer and Director. An economic geologist and capital markets strategist with over 20 years of experience in the mineral exploration sector. Mr. Elliott has a proven track record of identifying high-value assets and raising the necessary capital to scale junior explorers across the Americas. He was instrumental in the early-stage development of major discoveries, including Zafranal (Teck) and Stibnite Gold (Perpetua).

Manuel Montoya, P.Geo, General Manager, Peru: A veteran geologist with 36+ years of experience in global project generation and strategic exploration. Mr. Montoya previously led Teck’s exploration efforts across South America and is widely credited with the discovery of the Zafranal Cu-Au deposit in Peru. His technical expertise spans a diverse range of deposit types, including high-sulfidation epithermal systems, porphyries, and skarns.

Patrick Elliott, Chief Executive Officer and Director of Forte Minerals Corp, commented:

‘We are focused on the Alto Ruri Gold Project and the significant re-evaluation opportunity it presents.

Backed by two major strategic partners, we are positioned to advance this high-sulfidation system thoughtfully and systematically.

With gold near all-time highs, PDAC is the ideal venue to share our story with a new wave of investors and outline our next phase of exploration in Peru.’

Qualified Person and NI 43-101 Disclosure

Richard Osmond, P.Geo., an Independent Director, is the Company’s Qualified Person (‘Qualified Person’) as defined by National Instrument 43-101. He has reviewed and approved the technical information contained in this news release.

About Forte Minerals

Forte Minerals Corp. is a well-funded exploration company with a strong portfolio of high-quality copper and gold assets in Peru. Through a strategic partnership with GlobeTrotters Resources Perú S.A.C., the Company gains access to a rich pipeline of historically drilled, high-impact targets across premier Andean mineral belts. The Company is committed to responsible resource development that generates long-term value for shareholders, communities, and partners.

On behalf of Forte Minerals Corp.

(signed) ‘Patrick Elliott

Patrick Elliott, MSc, MBA, PGeo

President & Chief Executive OfficerT: (604) 983-8847

Investor Inquiries

Kevin Guichon, IR & Capital Markets

E: kguichon@forteminerals.com

C: (604) 612-0997 |

Media Contact

Anna Dalaire, VP Corporate Development

E: adalaire@forteminerals.com |

info@forteminerals.com

www.forteminerals.com |

Follow Us On Social Media: LinkedIn | Instagram | X | Meta | The Drill Down; Newsletter |

| |

|

Certain statements included in this press release constitute forward-looking information or statements (collectively, ‘forward-looking statements’), including those identified by the expressions ‘anticipate’, ‘believe’, ‘plan’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘should’ and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements relating to the intended use of proceeds of the Strategic Placement. These forward-looking statements and information reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company with respect to the matter described in this press release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under ‘Risk Factors and Uncertainties’ in the Company’s latest management’s discussion and analysis, which is available under the Company’s SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future.

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management’s reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information or statements to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company’s forward-looking statements.

Neither the Canadian Securities Exchange (the ‘CSE’) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3dc98d3f-6818-4e65-9eda-55a4ebd3a405

https://www.globenewswire.com/NewsRoom/AttachmentNg/b0f95451-b6b1-48d2-aeb0-18f0588e2dbe