Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project’s Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide (‘VMS’) system in Ontario, Canada.

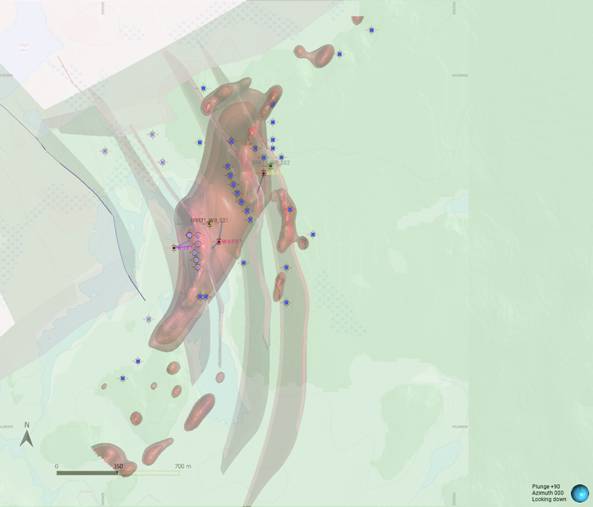

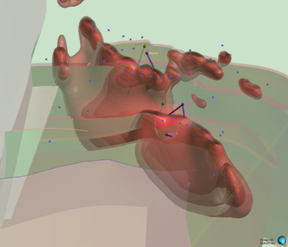

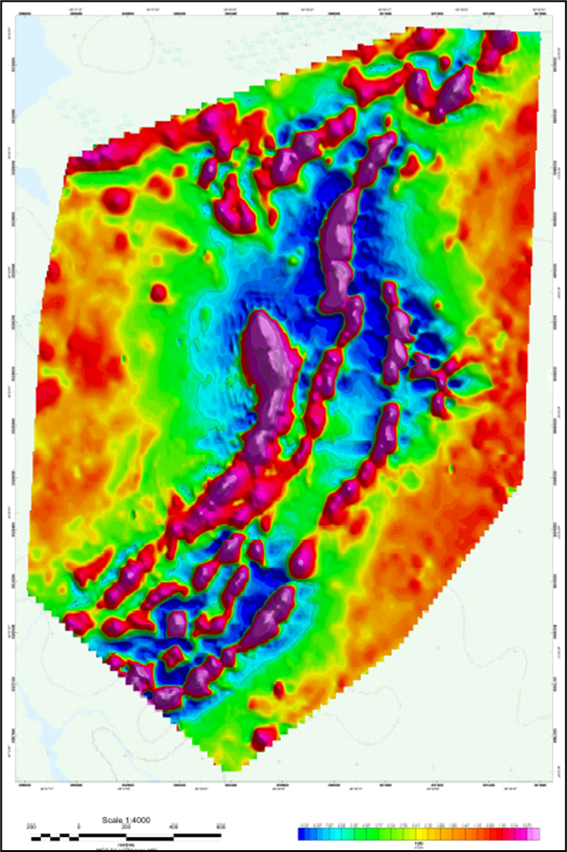

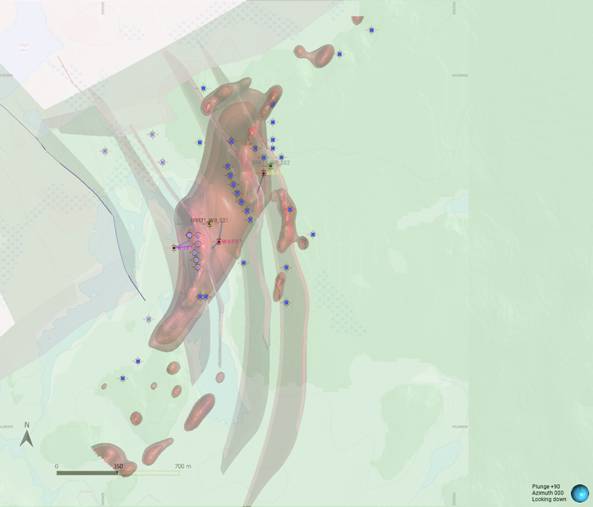

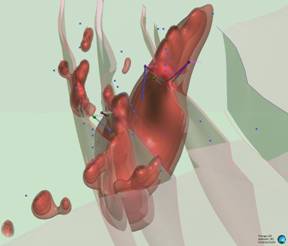

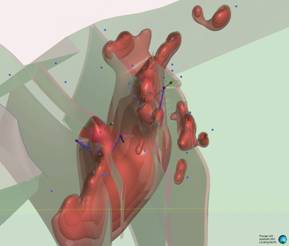

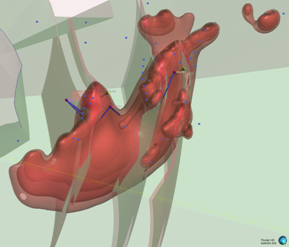

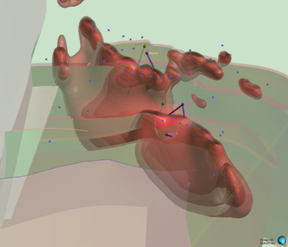

Following the completion of the 2025 high resolution drone based airborne magnetic geophysics survey (‘Magnetics Survey’) over the Wishbone Prospect, the geophysical data has subject to three-dimensional inversion modelling (Figures 1 & 2) with a view to refining the parameters of the permitted drill holes ahead of a diamond drilling programme.

A video illustrating the results of the Magnetic Survey inversion modelling and the size and morphology of the Wishbone VMS Target and the relationship with highly anomalous copper in lake sediments is available to view on the Panther Metals PLC YouTube channel at https://youtube.com/shorts/POMgfQuSc44?feature=share1

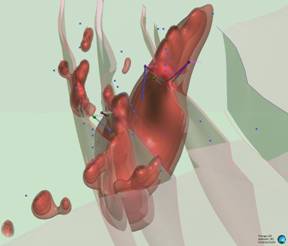

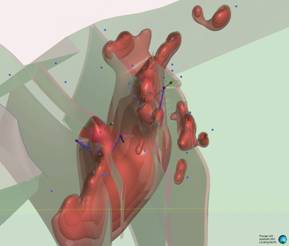

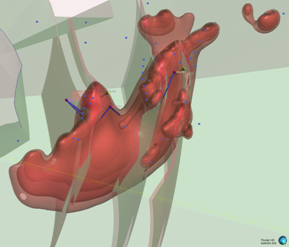

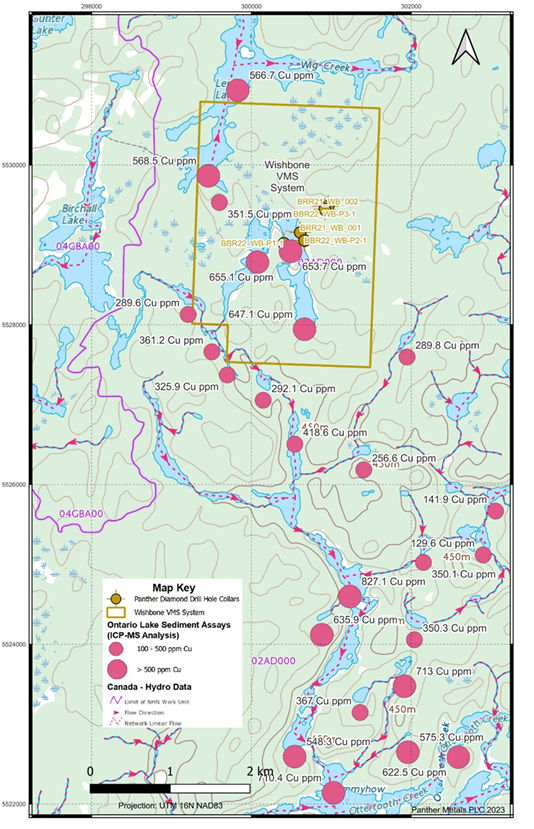

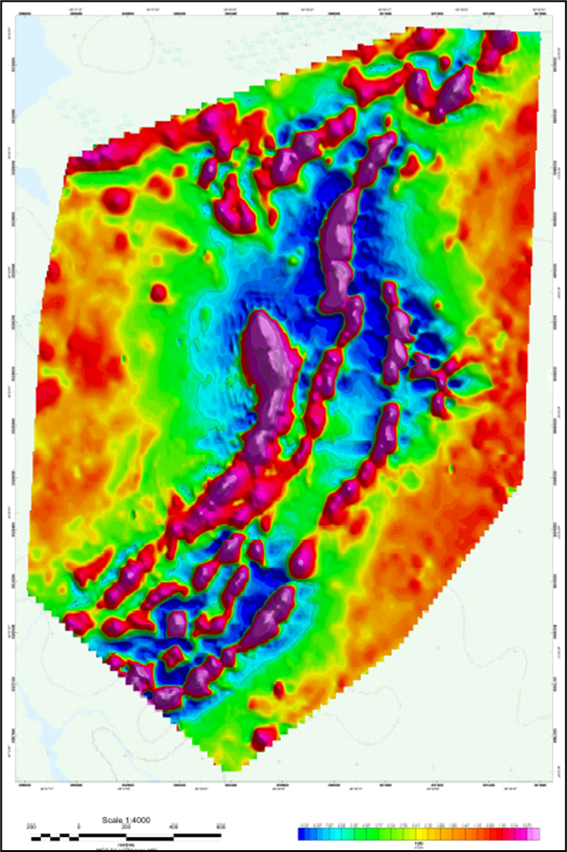

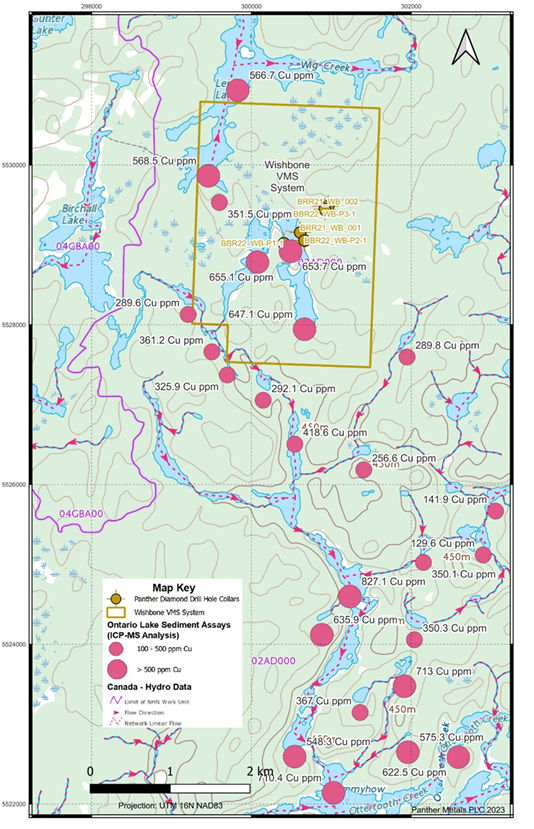

Figures of the magnetics inversion and structural model are set out below in Figures 1 and 2, whilst the map the processed First Vertical Derivative of the Magnetic Survey data is shown in Figure 3. Figure 4 shows the highly anomalous copper in lake and stream sediments which are located above, and which drain off the site of the Wishbone VMS Prospect. Details of the Magnetic Survey are provided in Table 1.

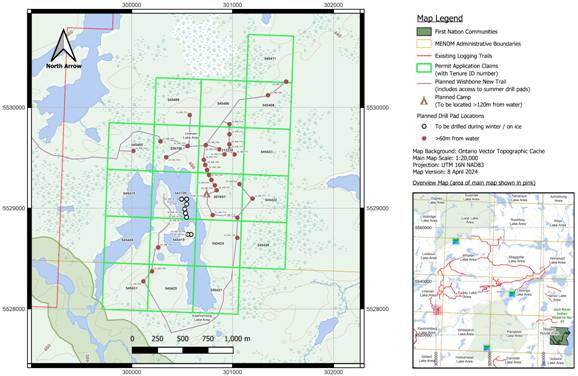

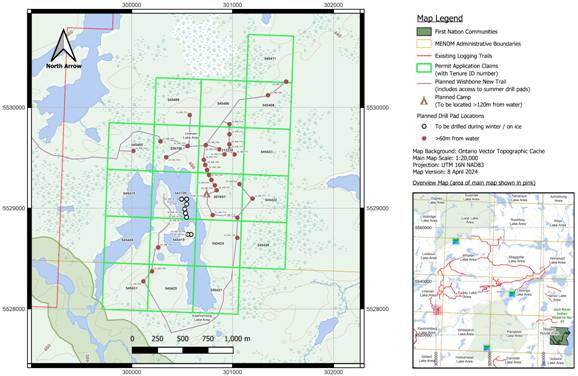

The work being planned is covered by Exploration Permit PR-24-000022, which is valid through to 20 June 2027 (Figure 5). This permit authorises a comprehensive exploration programme, including up to 39 diamond core drill holes and down-hole electromagnetic geophysics.

Darren Hazelwood, Chief Executive Officer commented:

‘As move towards and period of intense work activity at the exciting Wishbone VMS Prospect, we would like to provide an update on our geological and magnetic inversion modelling activities which illustrate the scale of the Wishbone system that we will be drill targeting in the coming quarter.

Panther Chairman Nick O’Reilly and I will be at the PDAC Conference in Toronto next week where we will be meeting with various Wishbone stakeholders, and we look forward to providing further updates as our plans advance.’

|

|

|

Figure 1: Plan view of modelled Wishbone VMS Target showing magnetic inversion model, geological contacts and location of Panther diamond drillholes (based on magnetic inversion model shells).

Notes: Scale bar and north arrow in bottom left corner of figure. Coordinates stated in UTM Zone 16N NAD 83 datum. Image highlights the size of the modelled magnetic body at depth. Dark blue dots signify permitted drill pad locations. The figure is overlain by a semi-transparent surface rendering of the topographical map, from which the trace of the Wishbone Lake can be discerned (light blue). The green block model below the topography reflects the greenstone volcanic geology, the beige block model to the north is granitoid. The granitoid/volcanic contacts are interpreted to be faulted. A series of three concave fault/contacts are currently interpreted to dissect the magnetic inversion model. The down-hole traces of Panther’s 2021 and 2022 drilling are shown in plan view. The working model is dynamic and will be updated as the 2026 work programme develops.

|

|

Looking south (180° / 45°)

|

Looking north (000° / 45°)

|

|

Looking north-westerly (340° / 45°)

|

Looking north-easterly (060° / 45°)

|

|

Figure 2: Series of oblique three-dimensional views of modelled of modelled Wishbone VMS Target showing location of Panther diamond drillholes (based on magnetic inversion model shells).

Notes: Image highlights the size of the modelled magnetic body at depth. Blue dots signify permitted drill pads. For relative scale and description of other features please see the notes below Figure 1.

|

|

|

|

Figure 3: First Vertical Derivative Magnetic Survey Map data from the 2025 Wishbone Survey.

Notes: The first vertical derivative map enhances shallow, near-surface geological features by calculating the rate of change of the magnetic field in the vertical direction. This acts as a high-pass filter to sharpen anomaly edges, reduce regional background noise and better resolve closely spaced magnetic bodies.

|

Wishbone VMS Target Background

The Wishbone Drone Magnetic Survey work followed on from the 2022 drill programme to target multiple high priority electromagnetic (‘EM’) and magnetic geophysical anomalies prospective for volcanogenic massive sulphide (‘VMS’) hosted copper / base metal mineralisation. Panther’s two hole 600m drilling programme in autumn 2021 had confirmed Wishbone as a VMS base metals target and the 2022 drilling sought to follow-up on the massive sulphide and zinc / copper intersections as well as to test further coincident magnetic and electromagnetic conductor geophysical anomalies identified by regional airborne surveys.

Historical drilling in the 1970s intersected massive stringer and disseminated sulphide 800m north of the Wishbone anomaly and drilling by BHP in the 1990s intersected massive stringer and disseminated sulphide 600m south of the anomaly.

BHP ranked the Wishbone anomaly a high priority for follow up in 1992, however no further work was completed prior to 2021. Airborne geophysics datasets compiled since that time have shown that the historical drilling failed to intersect the major anomalies.

Wishbone is situated in a similar geological environment to the nearby Sturgeon Lake VMS mining camp, on the Wabigoon Greenstone Belt, approximately 75km due west. The Sturgeon Lake VMS Camp is host to five historic zinc-copper-lead-silver producing mines, with a combined total production of: 19.8Mt @ 8.50% Zn, 1.06% Cu, 0.91% Pb & 119.7g/t Ag.

In 2021 Panther’s two hole, 600m diamond drilling programme, intercepted multiple lenses of sulphide mineralisation including in drill hole BBR21_WB_001 a 27.3m wide intercept of massive sulphide mineralisation and in hole BBR21_WB_002 51m of sulphide-dominated mineralisation.

Wide massive sulphide and semi-massive sulphide mineralisation intersections were made in both drill holes:

- WB001: Three wide sulphide intersections:

- 27.3m of massive sulphide from 106.2m (‘Upper layer’), with fault at base;

- 2.5m of massive sulphide from 234.8m (‘Mid layer’; and

- 1.4m of massive sulphide from 256.6m (‘Lower layer’)

- WB002: Wide zoned sulphide intersection:

- 51m from 174m comprising a wide zone of sulphide dominated mineralisation, including:

- 17m from 180m of massive sulphide (‘Upper zone’) and

- 7m from 218m of semi-massive sulphide (‘Lower zone’)

In Panther’s 2022 drill programme, a further three diamond drill holes intersected further massive and semi-massive sulphides, and a zone of zinc mineralisation:

- Hole BBR22 WB-P1-2: Potentially commercial grades of zinc mineralisation:

- 3.6m @ 3.9% Zn from 120m, including

- 2m @ 6.8% Zn, 4.3 g/t Ag and anomalous 0.19% Cu from 120m, with

- 0.5m @ 11.65% Zn, 4.1 g/t Ag and anomalous 0.14% Cu from 120.2m.

- Hole BBR22 WB-P2-1: Further wide zones of massive and semi-massive sulphide mineralisation intersected, interpreted to be related to the high temperature pyrrhotite dominant core of the VMS system:

- 22.4m of massive and semi-massive sulphide from 127m downhole.

- Hole BBR22 WB-P3-1 :

- 3.8m of semi-massive sulphide from 163.2m downhole.

The Wishbone discovery was the first significant VMS-style mineralisation to be made on the entire Obonga Greenstone Belt. Given the geological tendency for VMS systems to cluster and repeat and given the presence of highly anomalous copper in lake and stream sediments nearby (see Figure 4).

An important characteristic of VMS deposits is that they typically display a zonation of metals within the massive sulphide body from Fe+Cu at the base to Zn+Fe±Pb±Ba at the top and margins, related to differing temperature and chemical conditions at mineral deposition. The major observed mineral component of the Wishbone massive sulphide mineralisation is pyrrhotite with less common pyrite and minor sphalerite and chalcopyrite in distinct zones.

The Wishbone assay result suite, including rare earth element (‘REE’) analyses, has yielded important geochemical information allowing the classification of the mineralisation, alteration ratios and the development of exploration vectors towards zones of potential economic interest. Wishbone has been classified as a bimodal type deposit, the same type as Canada’s Kidd Creek (Ontario) and Noranda (Quebec) VMS deposits.

|

|

|

Figure 4: Lake Sediment Sample Assays Show Very Strong Copper Anomalism Downstream of the Wishbone VMS system

|

Table 1: Wishbone VMS Prospect UAV Magnetic Survey Details

|

UAV Magnetics Survey Rational

|

Survey Equipment

|

Survey Size

(25m line & 250m tie line spacing)

(line- kilometre)

|

Flight Line Azimuth (degrees)

|

Survey Data Products

|

|

Targeting VMS style base metal mineralisation at depth.

3D Inversion modelling will facilitate drill hole orientation planning to target the expected high base metal grade parts of the targeted VMS systems.

|

Unmanned Airborne magnetometer survey system incorporating:

Base station magnetometer GSM-19W Overhauser

Airborne magnetometer Gem Systems GSMP-35U potassium vapor magnetometer & ancillary electronics.

|

25m line & 250m tie line spacing

Total line kilometres:

190.11 km

|

090°

|

· Final Total Magnetic Intensity

· First Vertical derivative

· Second Vertical Derivative

· Horizontal Derivative

· Analytic Signal

· 3D Inversion Models

|

|

Figure 5: Wishbone Exploration Permit PR-24-000022 Permitted, Claim Cells, Drill Pads, Camp and Access

|

|

Note: Map from Permit issued on 21 June 2024

|

References

1. Panther Metals PLC, YouTube channel video: Wishbone VMS Target

( https://youtube.com/shorts/POMgfQuSc44?feature=share )

For further information, please contact:

|

Panther Metals PLC:

Darren Hazelwood, Chief Executive Officer:

|

+44 (0)1462 429 743

+44 (0)7971 957 685

|

|

Brokers:

|

|

|

Optiva Securities Limited

Christian Dennis

Mick McNamara

|

+44 (0)20 3137 1902

|

|

Hybridan LLP

Claire Louise Noyce

|

+44 (0)20 3764 2341

|

|

SI Capital Limited

Nick Emerson

|

+44 (0)1438 416 500

|

Obonga Project – Advancing a High-Impact VMS and Critical Minerals District

Panther Metals’ Obonga Project in Ontario continues to demonstrate strong potential as a district-scale exploration opportunity targeting base and critical minerals. Since acquiring the Obonga Greenstone Belt in July 2021, the Company has advanced multiple high-priority targets including Wishbone, Awkward, Survey, Ottertooth, and Silver Rim.

On 9 February 2026 Panther announced plans for an approximately 2,000-metre diamond drilling program at the Wishbone Prospect, following the grant of an Exploration Permit in June 2024 valid through 2027. Previous work confirmed compelling VMS-style mineralisation, including 27.3m of massive sulphide and 51m of sulphide-dominated mineralisation across multiple lenses, supported by high-grade copper anomalies in lake sediments.

In July 2024, Panther secured an Exploration Permit for Awkward West, enabling up to 31 drill holes. Historic drilling returned 27.2m at 2.25% TGC, with zones exceeding 5% TGC, alongside indications of nickel, copper, and platinum group elements, aligning with the Company’s critical minerals strategy.

High-resolution magnetic and electromagnetic surveys continue to refine drill targeting across Obonga. Survey and Ottertooth remain highly prospective, hosting multiple untested geophysical anomalies and historic massive sulphide intercepts.

Winston Project – Tailings Evaluation and MRE Pathway

Panther Metals’ Winston Project represents a near-term, development-focused opportunity centred on the evaluation of historic mine tailings and has been the subject of prior technical and commercial assessment involving Extrakt.

Current work is focused on tailings sampling, metallurgical testing, and data validation to define metal content, recoverability, and support the preparation of a Mineral Resource estimate (MRE). This approach provides a clear value-creation pathway with lower geological risk than greenfield exploration and aligns with modern reprocessing and critical mineral’s themes.

Dotted Lake Project – Hemlo-Adjacent Polymetallic Opportunity

Panther Metals’ Dotted Lake Project, acquired in July 2020, is located approximately 16km from the Hemlo Mining Corp.’s Hemlo Mine, within a well-established mining region.

Early exploration identified multiple gold and base metal anomalies, with initial drilling confirming gold mineralisation. In early 2025, follow-up drilling materially advanced the project, confirming nickel and magnesium mineralisation within an ultramafic intrusion and identifying a VMS-style system, significantly expanding the project’s polymetallic potential.

The programme refined structural controls, extended mineralisation, and identified multiple new drill targets, positioning Dotted Lake as a high-upside, multi-commodity exploration asset.

Commercial Strategy – Focused Value Creation

Panther Metals is focused on disciplined, discovery-driven value creation through efficient capital deployment and technical execution. With Obonga delivering high-impact exploration, Winston providing a resource-focused development pathway, and Dotted Lake offering polymetallic upside, the Company maintains a balanced portfolio aligned with favourable commodity market conditions.

The Company’s strategy is to advance high-quality assets along the most efficient technical pathway, delivering tangible milestones that underpin long-term shareholder value.

Source

This post appeared first on investingnews.com