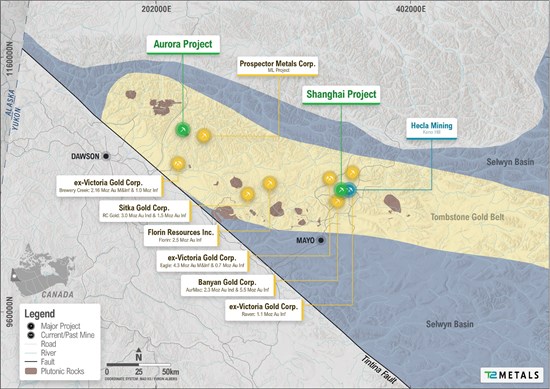

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) (‘T2 Metals’ or the ‘Company’) is pleased to announce signing of an Option Agreement (the ‘Option’) with renowned explorer Shawn Ryan (‘Ryan’) and Wildwood Exploration Inc. (together with Ryan, the ‘Optionor’) to earn a 100% interest in the 76 sq km Aurora Gold Project in prolific Tintina Gold Belt of the Yukon Territory, Canada.

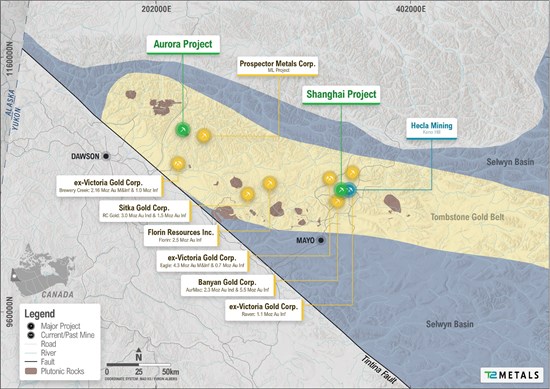

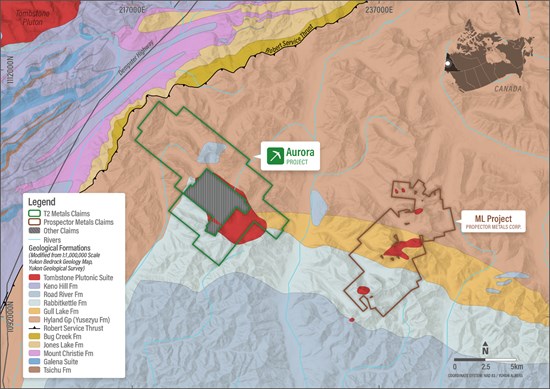

Aurora is an Intrusion Related Gold System (‘IRGS’) that lies 70 km northeast of Dawson City, is 2 km from the Dempster Hwy at its nearest point, and importantly only 10 km east of Prospector Metals Corp’s ML Project (see Figure 1).

Project Highlights:

- Situated close to Dawson City and adjacent to the Dempster Hwy, the Aurora Mineral Project spans a significant land package within the Tombstone Gold Belt, one of North America’s premier gold and silver mining districts.

- Aurora is geologically similar to the nearby ML Project of Prospector Metals Corp, where recent drilling has identified high grade gold-copper mineralization (e.g. 13.79 g/t Au and 1.84% Cu over 44m).

- The Aurora mineral claims are centred on the Antimony Mountain Stock, a Tombstone Plutonic Suite intrusion similar to other mid-Cretaceous intrusions that are genetically associated with major IRGS deposits in the Yukon and Alaska.

- Six significant gold-bearing prospects have been identified by Shawn Ryan and past explorers over a 10 km trend utilizing soil and rock chip sampling.

- Less than 3,000 m of drilling has been completed at Aurora, with no work undertaken for over 15 years.

- The Golden Wall Prospect has been sampled by past explorers and shows disseminated sulphides and iron oxide over a 400 m cliff face. Up to 61 g/t Au was discovered in outcrop, and Golden Predator drill hole GW10-028 returned 2 m @ 3.2 g/t Au.

Mark Saxon, CEO of T2 Metals Corp., said, ‘The acquisition of the Aurora Gold Project reinforces T2 Metals very strong entry into in the Yukon, built upon foundations laid by explorers Shawn Ryan and Cathy Wood over decades of exploration. Aurora is a well mineralized yet lightly explored mineral project that lies along strike from Prospector Metals’ new ML discovery. They have held the Aurora ground since 2004 and are very pleased to be entrusted with the ongoing exploration of this exciting property.’

Project partner, Shawn Ryan, commented, ‘Aurora is one of the highest prospectivity mineral projects I’ve held in the Yukon, and the nearby success of Prospector Metals reinforces its potential. I’m excited to be working with the T2 Metals technical team to see how this project develops.’

Figure 1: Regional Location of the Aurora Mineral Project, Yukon Territory, Canada.

See Table 2 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_002full.jpg

Exploration History

Exploration at Aurora has been intermittent since the first discovery of stibnite veins in 1916, which provided the early name for the area, Antimony Mountain. Notable work programs were conducted by Conwest Exploration (1966-1967), Anaconda Canada (1979-1980), Total Energold (1988-1989), and Kennecott (1994-1998).

More recently, Logan Resources and Golden Predator conducted soil sampling surveys and limited diamond drilling (2005-2011), intersecting significant gold mineralization and defining further high-grade targets at the AJ Vein and Golden Wall prospects (see Table 1 or https://data.geology.gov.yk.ca/Occurrence/14772#InfoTab).

Regional Geology

The Aurora Gold Project lies near the western edge of the Selwyn Basin in the northwest of the Yukon Territory. The stratigraphy consists of late Proterozoic to Palaeozoic marginal basinal and platformal clastic and pelitic sediments, intruded by post-accretionary mid-Cretaceous plutons. The Tombstone Plutonic Suite (93-91 Ma) are represented by alkalic monzonites and syenites often associated with intrusion-related gold deposits, most often exposed in the western part of the Selwyn Basin, close to the Tintina Fault (Stephens et al., 2004; Colpron et al., 2011).

Table 1. Aurora Gold Project history, taken from Yukon Geological Survey records.

| Company |

Date(s) |

Work Performed |

Significant Mineralization Noted |

| Mr. W Walker |

1916-1918 |

5.5 m adit and hand trenching in stibnite veins in an aplite dyke. |

Sb |

| Conwest Exploration & Central Patricia Gold Mines |

1966-1967 |

Staking, geochem, geophysics, mapping, and 4 drill holes (200.9m). |

Au: Up to 120.0 g/t over 1.3m (North showing); 28.5 g/t over 2.8m in drilling. |

| Cream Silver Mines |

1970 |

Geological mapping and hand trenching of Rainbow and JC veins |

N/A |

| Acheron Mines (later Pan Acheron Resources) |

1975-1976 |

Mapping, geochem, hand trenching, and 3 drill holes (166.1m). |

Au: 20.6 g/t over 3.1m (South showing vein) in drilling. |

| Standard Oil Company |

1975-1976 |

Airborne radiometric survey, stream sediment survey over Antimony Mtn stock; ground radiometrics. |

N/A |

| Anaconda Exploration Ltd |

1979-1980 |

Mapping and geochemical sampling, 4 DDH totalling 1000 m in the Rainbow and JC veins. |

N/A |

| Riocanex Inc. |

1980 |

Electromagnetic (EM) survey. |

N/A |

| Cody Hawk Resources |

1982-1988 |

Mapping, EM surveys, rock sampling, and trenching. |

Au: Identified association with quartz-tourmaline-sulphide veins in hornfels. |

| Total Energold Corp |

1988-1989 |

Mapping, geochem, airborne/surface geophysics, trenching, 6 drill holes (756m). |

Au: 22.8 g/t over 1.53m; 7.9 g/t and 7.5 g/t over 1.8m in drilling. |

| Kennecott Canada Inc. |

1994-1998 |

Large-scale mapping, soil/stream/rock sampling, and prospecting. |

Au: Float samples of 19.0 g/t and 7.24 g/t; 69.0 g/t Au from Toby Creek vein outcrop. |

| Prospector International Resources |

1997-1998 |

Staking, stream sampling, and prospecting. |

Ag/Pb/Zn: 15.6 ppm Ag, 1.3% Pb, and 6.5% Zn (For Sure claims). |

| Strategic Metals / War Eagle JV |

2004 |

Prospecting, soil sampling, mapping, trenching, and 4 drill holes (832m). |

Au/Cu: 20-40m intervals of 200-300 ppb Au; associated with chalcopyrite (Cu). |

| Logan Resources / Golden Predator |

2005-2011 |

12 diamond drill holes on the AJ target. |

Au: 12.45 g/t over 4.88m; 5.55 g/t over 0.49m; 9.24 g/t over 0.31m. |

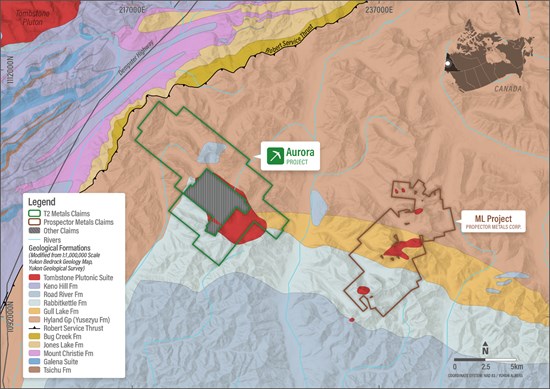

Property Geology

The Aurora Project is underlain by Late Proterozoic to Lower Cambrian clastic metasediments of the Hyland Group (Yusezyu and Narchilla Formations) which consist of interbedded shale, quartzite, and coarse sandstone. These are transitionally overlain by the Road River Group, comprised of calcareous greywacke, siltstone, and limestone (see Figure 2).

The central part of the project is underlain by the Mid-Cretaceous (93-91 Ma) Antimony Mountain Stock (AMS), part of the Tombstone Plutonic Suite. The stock is an elongate, 7 x 3.5 km body of hornblende syenite to quartz monzonite. It exhibits a porphyritic texture with alkali feldspar phenocrysts and is fringed by a fine-grained diorite phase. Notably, the northern part of the stock is essentially non-magnetic (reduced), while the southern portion is highly magnetic (oxidized), suggesting multiple intrusive pulses.

Aurora is strategically located between the Tintina Fault to the south and the Dawson Thrust Fault to the north, with the Robert Service Thrust situated on the western edge of the property. This regional-scale fault network has provided access for hydrothermal fluids associated with the younger Tombstone-age intrusions.

The property is characterized by isoclinal folding and east-west trending faults that act as local conduits for precious and base metal mineralizing fluids. A massive hornfels aureole extends up to 1 km from the Antimony Mountain Stock margins, where sedimentary rocks are intensely silicified and include finely disseminated pyrrhotite and pyrite, creating prominent iron oxide (limonite, goethite) stained rusty ridges. Skarn/calc-silicate replacement alteration (diopside-epidote-actinolite) is locally developed where the intrusion contacts limey sediments.

Figure 2: Regional Geological Map for Aurora Project, Yukon Territory, Canada.

See Table 1 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_003full.jpg

Mineralization

The Aurora Gold Project is located 10 km west of Prospector Metals Corp’s ML Project, in the heart of the Tombstone Gold Belt, a region renowned for large-scale Intrusion Related Gold Systems. Much like the ML Project, Aurora overlies and is adjacent to a Tombstone-age intrusion that remains significantly underexplored despite high-grade historical drilling intersections. Both properties demonstrate precious and base metal mineralization with potential for bulk-tonnage porphyry Au-Cu, high-grade Au sheeted veins, and skarn replacement mineralization. The exploration success at the ML Project, characterized by its high-grade copper-gold intersections, provides a compelling geological analogue for the untapped potential at T2 Metals’ Aurora Project.

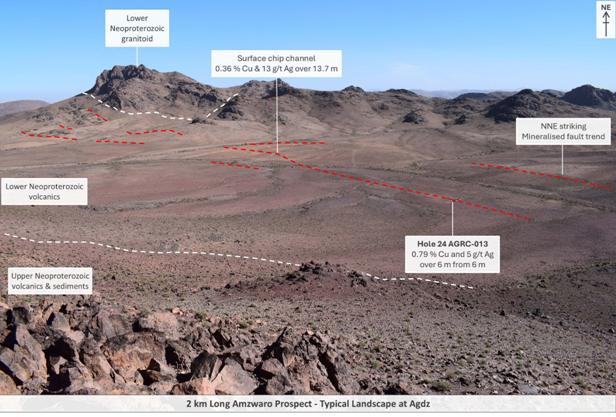

Six significant gold-bearing prospects have been identified at Aurora by past explorers over a 10 km trend utilizing soil and rock chip sampling (see Figure 3). High-grade quartz-arsenopyrite-tourmaline veins are commonly mapped in fault controlled east-trending orientations. The AJ Vein is the most significant vein mapped to date, traced for over 700 m, with historical intercepts of 28.5 g/t Au over 2.74 m. Other known veins include the JC, Rainbow, TK, and TT showings. The Golden Wall prospect displays stratabound disseminated sulphide (arsenopyrite-pyrite-pyrrhotite) in calcareous siltstones and quartzites with potential for bulk-tonnage porphyry-style mineralization within the AMS and broad stockwork zones within the contact metamorphic halo.

Figure 3: Local Geological Map for Aurora Project, Yukon Territory, Canada Including Know Gold Prospects.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_004full.jpg

Next Steps

T2 Metals is now integrating all historical geophysical and geochemical data to refine targets for a comprehensive diamond drilling program. Focus will be placed on the Golden Wall prospect which remains untested, expanding the known mineralization at the AJ Vein, and testing other undrilled gold-bearing prospects.

Option Terms

Subject to receipt of TSX Venture Exchange (‘TSXV’) approval of the Option Agreement, T2 Metals will have the option to acquire a 100% undivided interest in the Aurora mineral project, for a total consideration of $850,000 in cash and 3,500,000 common shares of T2 Metals to be paid to the Optionor in incremental amounts over a seven-year period, which may be accelerated at the discretion of T2 Metals. An initial cash payment of $75,000 and an initial payment of 400,000 common shares in T2 Metals will be made following TSXV acceptance of the Transaction. All shares issued under the Option Agreement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

In order to exercise the Option, T2 Metals is also required to incur exploration expenditures on the Aurora mineral project totalling a minimum of $2,500,000 over eight years, including $100,000 by November 15, 2026. On completion of an NI 43-101 compliant Feasibility Study, $1 per Indicated and Measured resource estimate ounces of gold will be payable to the Optionor. Upon commencement of commercial production on the Aurora mineral project, the Optionor will retain a 2.5% net smelter return royalty on the property with 1% purchasable by T2 Metals for the cash payment of $2,000,000 to the Optionor.

Furthermore, the Company will pay a 5% finder’s fee to an arm’s-length party in consideration for their efforts in introducing the Company to the Aurora opportunity. The finders fee will be paid on the equivalent schedule as payments to the Optionor and is in accordance with the policies of the TSX Venture Exchange.

The mineral claims are located principally within the traditional territory of the Trʼondëk Hwëchʼin First Nation, which has settled its land claim, and is a self-governing first nation.

About Shawn Ryan

Shawn Ryan is a well-known prospector and entrepreneur in the Yukon’s mineral exploration industry and sits on T2 Metals Advisory Board. He is recognized for his innovative and systematic approach to gold exploration, which has been credited with sparking a ‘second Klondike gold rush.’ Mr. Ryan’s career is marked by a methodical approach to sampling, including development of a novel auger soil sampling technique, a method particularly effective in the Yukon where thick soil layers often obscure bedrock.

Shawn Ryan’s work has led to several significant discoveries including the Golden Saddle and Arc deposits, which became part of the multi-million ounce White Gold Project acquired by Kinross Gold; and the Coffee project, which was sold to Goldcorp (now Newmont Corporation) for $520 million and is now being advanced to production by Fuerte Metals Corp. His contributions to the industry have earned him numerous awards, including the Bill Dennis Award for prospecting from the Prospectors & Developers Association of Canada (PDAC). Shawn’s work is seen as a major factor in modernizing exploration in the Yukon and drawing new attention to the territory’s mineral potential.

Table 1: Gold Deposits in the Tombstone Gold Belt with NI43-101 References

| Project |

EFFECTIVE DATE |

Author |

Report For |

Tonnes (M) |

Au (g/t) |

Contained Gold |

Status |

| Brewery Creek |

18/01/2022 |

Cook. C. et al., 2022. |

Sabre Gold Mines Corp |

34.5 |

1.03 |

1.142 M oz |

Measured & Indicated |

|

|

|

|

36.0 |

0.88 |

1.018 M oz |

Inferred |

| Report Title: Preliminary Economic Assessment. NI 43-101 Technical Report on the Brewery Creek Project Yukon Territory, Canada |

| Eagle (Dublin Gulch) |

31/12/2022 |

Harvey, N., 2022 |

Victoria Gold

Corp |

233.2 |

0.57 |

4.303 M oz |

Measured & Indicated |

|

|

|

|

36.2 |

0.62 |

0.724 M oz |

Inferred |

| Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada |

| Olive (Dublin Gulch) |

31/12/2022 |

Harvey, N., 2022 |

Victoria Gold

Corp |

11.6 |

0.97 |

0.361 M oz |

Measured & Indicated |

|

|

|

|

5.5 |

1.17 |

206,479 |

Inferred |

| Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada |

| Raven (Dublin Gulch) |

15/09/2022 |

Jutras, M., 2022. |

Victoria Gold

Corp |

19.9 |

1.67 |

1.071 M oz |

Inferred |

| Report Title: Technical Report On The Raven Mineral Deposit, Mayo Mining District Yukon Territory, Canada |

| Blackjack (RC Gold) |

21/01/2025 |

Simpson. R., 2025 |

Sitka Gold

Corp |

39.9 |

1.01 |

1.298 M oz |

Indicated |

|

|

|

|

34.6 |

0.94 |

1.045 M oz |

Inferred |

| Report Title: Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory |

| Eiger (RC Gold) |

19/01/2023 |

Simpson. R., 2025 |

Sitka Gold

Corp |

27.4 |

0.5 |

0.440 M oz |

Inferred |

| Report Title: Clear Creek Property, RC Gold Project. NI 43-101 Technical Report. Dawson Mining District, Yukon Territory |

| Airstrip (AurMac) |

28/06/2025 |

Jutras, M., 2025 |

Banyan Gold

Corp |

27.7 |

0.69 |

0.614 M oz |

Indicated |

|

|

|

|

10.1 |

0.75 |

0.244 M oz |

Inferred |

| Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada |

| Powerline (AurMac) |

28/06/2025 |

Jutras, M., 2025 |

Banyan Gold

Corp |

84.8 |

0.61 |

1.663 M oz |

Indicated |

|

|

|

|

270.4 |

0.60 |

5.216 M oz |

Inferred |

| Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada |

| Florin |

6/04/2025 |

Simpson. R., 2021 |

St. James Gold

Corp |

170.9 |

0.45 |

2.474 M oz |

Inferred |

| Report Title: Florin Gold Project. NI 43-101 Technical Report. Mayo and Dawson Mining Districts, Yukon Territory |

| Valley (Rouge) |

15/05/2025 |

Burrell. H. et al., 2024 |

Snowline Gold

Corp |

75.8 |

1.66 |

4,047 M oz |

Indicated |

|

|

|

|

81.0 |

1.25 |

3.256 M oz |

Inferred |

| Report Title: Rogue Project. NI 43-101 Technical Report and Mineral Resource Estimate. Yukon Territory, Canada |

About the Tombstone Gold Belt

The Tombstone Gold Belt, a component of the larger Tintina Gold Province, is a highly prospective metallogenic province in the Yukon, with a range of well-known and emerging gold discoveries. The belt is characterized by a suite of mid-Cretaceous, reduced, felsic intrusions known as the Tombstone Plutonic Suite. These intrusive bodies and the surrounding host rocks have created conditions for the formation of numerous Intrusion-Related Gold Systems (IRGS). Exploration efforts have identified multiple mineralized corridors with gold hosted in sheeted quartz veins and disseminated mineralization within both the intrusive bodies and the hornfelsed country rocks.

Gold mineralization in the Tombstone Gold Belt is typically associated with a distinctive multi-element signature that includes bismuth, tellurium, and tungsten, along with arsenic and antimony. Gold-bearing fluids exsolved from cooling intrusions and preferentially deposited gold in brittle, structurally controlled environments. Both high-grade, structurally-controlled vein systems and lower-grade, bulk-tonnage deposits are known. The region hosts numerous significant deposits and is the site of recent discoveries by companies such as Snowline Gold Corp., Banyan Gold Corp., Sitka Gold Corp. and Prospector Metals Corp.

Disclaimers

The qualified person (as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects) for the Company’s projects, Mr. Mark Saxon, the Company’s Chief Executive Officer, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists, has reviewed and approved the contents of this release.

Readers are cautioned that the discussion about adjacent or similar properties in this press release is not necessarily indicative of the mineralization or potential of the Aurora property. The Company has no interest in or right to acquire any interest in any such adjacent properties.

About T2 Metals Corp (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD)

T2 Metals Corp is an emerging copper and precious metal company enhancing shareholder value through exploration and discovery. T2 Metals is committed to engage with rights holders and stakeholders with the highest level of respect, ensuring that our exploration activities contribute positively to the communities in which we operate.

ON BEHALF OF THE BOARD,

‘Mark Saxon’

Mark Saxon

President & CEO |

For further information, please contact:

t2metals.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

info@t2metals.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

References:

Colpron, M. and Nelson, J.L., 2011. A Palaeozoic NW Passage and the Timanian, Caledonian and Uralian connections of some exotic terranes in the North American Cordillera.

Stephens, J.R., Mair, J.L., Oliver, N.H., Hart, C.J. and Baker, T., 2004. Structural and mechanical controls on intrusion-related deposits of the Tombstone Gold Belt, Yukon, Canada, with comparisons to other vein-hosted ore-deposit types. Journal of structural geology, 26(6-7), pp.1025-1041.

Cautionary Note Regarding Forward-Looking Statements

Certain information set out in this news release constitutes forward-looking information. Forward-looking statements are often, but not always, identified by the use of words such as ‘seek’, ‘anticipate’, ‘plan’, ‘continue’, ‘estimate’, ‘expect’, ‘may’, ‘will’, ‘intend’, ‘could’, ‘might’, ‘should’, ‘believe’ and similar expressions. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Although the Company believes that the expectations reflected in forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. Such risks include uncertainties relating to exploration activities. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

Source

This post appeared first on investingnews.com