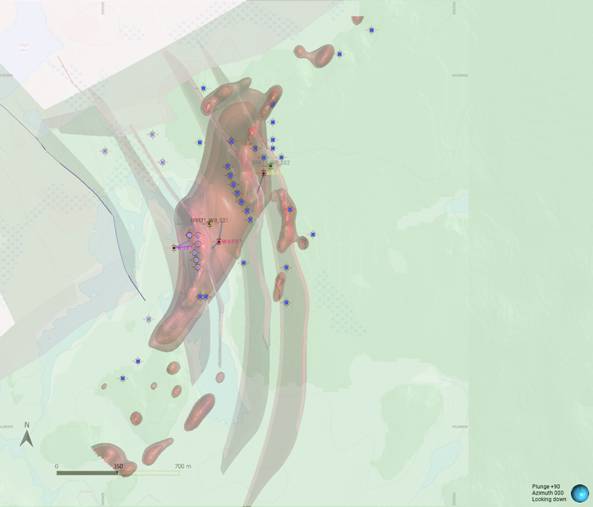

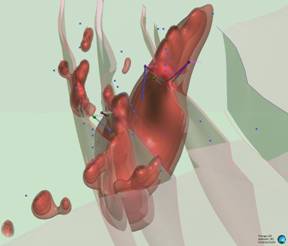

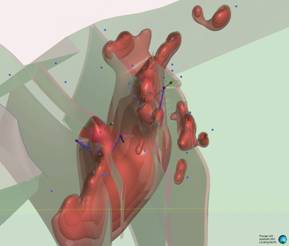

Bold Ventures Inc. (TSXV: BOL,OTC:BVLDF) (the ‘Company’ or ‘Bold’) is pleased to provide an update on diamond drilling progress at its Burchell Base and Precious Metals Project, located 100 km west of Thunder Bay, Ontario. 4 holes totaling 669 meters have now been completed in the vicinity of the 111 Zone, where channel sampling results from last Fall were reported last December (see Bold news release dated December 2nd, 2025), and where one grab sample from December 2024 returned 68 gt Au (see Bold news release dated January 9th, 2025). 663 samples of drill core have now been submitted to the laboratory and results are pending. While awaiting results from this first phase of drilling, the drill has been moved to Bold’s Wilcorp property located approximately 13 km east of Atikokan, Ontario, and drilling has commenced there.

Bold’s CEO David Graham, President and COO Bruce MacLachlan, and VP Exploration Coleman Robertson will be meeting with investors at booth #2610 at the Prospectors and Developers Association of Canada (PDAC) Mineral Exploration and Mining Convention in Toronto from March 1st to 4th, 2026. Coleman Robertson will be presenting at the PDAC Spotlight with a talk titled ‘From Burchell to the Ring of Fire,’ at 11:10 a.m. on Monday March 2nd in the Northern Lights Learning Hub, Level 300, Hall A of the North Building of the Metro Toronto Convention Centre. During PDAC Bruce MacLachlan will also be interviewed by the Northern Miner on March 1st, and by CEO.CA on Monday March 2nd.

In continuing to build Bold’s name recognition and corporate message via video and digital media platforms, the Company will pay fees of $4,520 to the Northern Miner Group and $4,350 to CEO.CA for the interviews which will conclude at the end of the conference and will remain available for viewing at Bold’s website, www.boldventuresinc.com. The Northern Miner draws on 110 years of experience as the leading mining industry journal in Canada to cover the top developments and newsmakers around the globe. CEO.CA is a community for investors & traders in junior resource & venture stocks and is one of the most popular free financial websites and apps in Canada and for small-cap investors globally — with industry leading audience engagement and mobile functionality.

The Company has registered for the Resourcing Tomorrow 2026 convention to be held from Dec. 1-3 2026 at the Business Design Centre in London, UK. To optimize that event and to build Bold’s name recognition and brand in the United Kingdom, Bold has signed a 12-month contract with The Armchair Trader (Armchair Trader Limited) based in the United Kingdom. The contract begins immediately and provides promotional services to Bold Ventures for a fee of $10,000.

The Northern Miner Group, CEO.CA and Armchair Trader Limited are all arm’s length to the Company and do not have any interest, directly or indirectly, in the Company or its securities, or any right or intent to acquire such an interest.

Ring of Fire News

In other news, the Marten Falls Community Access Road project has moved to the public review stage. The road, which will provide year-round access to the community, is proposed to connect to a forestry road north of Aroland First Nation. The road is part of a broader plan to connect the Ring of Fire to Ontario’s highway network, which also includes the Northern Road Link and Webequie Supply Road projects. See links below:

Marten Falls road project moves to public review stage – Northern Ontario Business

Ontario First Nations complete fast-tracked assessments for Ring of Fire road | Globalnews.ca

The proposed Eagle’s Nest mine in the Ring of Fire has also cleared another regulatory hurdle. The Federal government has decided not to designate the mine for impact assessment. See link below:

https://globalnews.ca/news/11688531/ring-of-fire-northern-ontario/

About Bold’s Koper Lake Project in the Ring of Fire

The Koper Lake Project is a joint venture between Bold Ventures Inc. and Canada Chrome Corporation Inc. (CCC – formerly KWG Resources Inc.) where CCC is the Operator of the exploration effort.

Bold holds a 10% carried interest (through to production) in the Black Horse Chromite deposit on the Koper Lake Project which hosts an NI 43-101 Inferred Resource of 85.9 Mt grading 34.5% Cr2O3 at a cut-off of 20% Cr2O3 (KWG Resources Inc., NI 43-101 Technical Report, Aubut 2015). Bold also holds a 40% working interest in all other metals found within the Koper Lake claims and has a Right of First Refusal on a 1% NSR covering all metals found within the claim group.

The Black Horse is contiguous with the Blackbird Chromite deposits owned by Ring of Fire Metals (formerly Noront Resources Inc.). The Koper Lake claims are located approximately 300 m from the Eagle’s Nest Ni-Cu Massive Sulphide Deposit that is in the permit acquisition stage.

Chromite, nickel and copper are critical minerals that will play an important role in the electrification plans of Ontario and North America. The Company is encouraged by these ongoing developments in this emerging critical mineral mining camp.

The technical information in this news release was reviewed and approved by Coleman Robertson, B.Sc., P. Geo., the Company’s V.P. Exploration and a qualified person (QP) for the purposes of NI 43-101

Bold Ventures management believes our suite of Battery, Critical and Precious Metals exploration projects are an ideal combination of exploration potential meeting future demand. Our target commodities are comprised of: Copper (Cu), Nickel (Ni), Lead (Pb), Zinc (Zn), Gold (Au), Silver (Ag), Platinum (Pt), Palladium (Pd) and Chromium (Cr). The Critical Metals list and a description of the Provincial and Federal electrification plans are posted on the Bold website here.

About Bold Ventures Inc.

The Company explores for Precious, Battery and Critical Metals in Canada. Bold is exploring properties located in active gold and battery metals camps in the Thunder Bay and Wawa regions of Ontario. Bold also holds significant assets located within and around the emerging multi-metals district dubbed the Ring of Fire region, located in the James Bay Lowlands of Northern Ontario.

For additional information about Bold Ventures and our projects, please visit boldventuresinc.com or contact us at 416-864-1456 or email us at info@boldventuresinc.com.

| ‘Bruce A MacLachlan’ | ‘David B Graham’ |

| Bruce MacLachlan | David Graham |

| President and COO | CEO |

Direct line: (705) 266-0847

Email: bruce@boldventuresinc.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements: This Press Release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words ‘may’, ‘would’, ‘could’, ‘will’, ‘intend’, ‘plan’, ‘anticipate’, ‘believe’, ‘estimate’, ‘expect’ and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to such risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forward-looking statements.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285792

News Provided by TMX Newsfile via QuoteMedia