Metro Mining (MMI:AU) has announced 2025 Financial Results

Metro Mining (MMI:AU) has announced 2025 Financial Results

Download the PDF here.

Metro Mining (MMI:AU) has announced 2025 Financial Results

Metro Mining (MMI:AU) has announced 2025 Financial Results

Download the PDF here.

Zeus Resources Limited (ZEU:AU) has announced Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in Trading

Download the PDF here.

Metro Mining (MMI:AU) has announced Appendix 4E

Metro Mining (MMI:AU) has announced Appendix 4E

Download the PDF here.

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall project

Download the PDF here.

ThreeD Capital Inc. (‘ThreeD’ or the ‘Company’) (CSE:IDK OTCQX:IDKFF) a Canadian-based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors, is excited to announce additional YouTube interviews with certain portfolio companies of ThreeD.

Already uploaded on ThreeD’s YouTube channel are several recent interviews with companies such as AI/ML Innovation Inc. (CSE: AIML), Neurable Inc., Hypercycle, and TODAQ Micro Inc,. to name a few.

In the coming weeks ThreeD plans to complete additional interviews with portfolio companies, including with Forte Minerals Corp. (‘Forte Minerals’) (CSE: CUAU,OTC:FOMNF). Forte Minerals is a Canadian exploration company with copper and gold assets in Peru. Forte Minerals recently provided updates on its operations referenced in its press release dated November 26, 2025 and its press release dated February 24, 2026.

The companies noted above do not represent all of ThreeD’s portfolio holdings. The holdings of securities of investees by ThreeD are managed for investment purposes. ThreeD could increase or decrease its investments in these companies at any time, or continue to maintain its current position, depending on market conditions or any other relevant factor.

About ThreeD Capital Inc.

ThreeD is a publicly-traded Canadian-based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors. ThreeD’s investment strategy is to invest in multiple private and public companies across a variety of sectors globally. ThreeD seeks to invest in early stage, promising companies where it may be the lead investor and can additionally provide investees with advisory services and access to the Company’s ecosystem.

| For further information: |

|

Jakson Inwentash |

| Vice President Investments |

| jinwentash@threedcap.com Phone: 416-941-8900 ext 107 |

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements. Often, but not always, these forward looking statements can be identified by the use of words such as ‘estimate’, ‘estimates’, ‘estimated’, ‘believes’, ‘hopes’, ‘potential’, ‘open’, ‘future’, ‘assumed’, ‘projected’, ‘used’, ‘detailed’, ‘has been’, ‘gain’, ‘upgraded’, ‘offset’, ‘limited’, ‘contained’, ‘reflecting’, ‘containing’, ‘remaining’, ‘to be’, ‘periodically’, or statements that events, ‘could’ or ‘should’ occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, risks relating to the prospectivity of the Company’s investments, determinations of the Company to increase or decrease its investment in any given investee from time to time, and such risks detailed from time to time in the Company’s filings with securities regulators and available under the Company’s profile on SEDAR at www.sedarplus.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

![]()

News Provided by GlobeNewswire via QuoteMedia

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern Nevada, approximately 40 kilometers southeast of Reno. The Company has three mineralized structures: The Comstock Lode, The Occidental/Brunswick Lode and The Silver City Spur. The Comstock Lode is an epithermal gold and silver deposit in a large fault system at the eastern base of the Virginia Range. The Occidental/Brunswick Lode is a gold and silver mineralized epithermal system in approximately 1.5 kilometers east of the main Comstock Lode and running parallel to it. The Silver City Spur is a branch of the Comstock Lode that runs southeast and connects with the southwestern splays of the Occidental Lode.

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern Nevada, approximately 40 kilometers southeast of Reno. The Company has three mineralized structures: The Comstock Lode, The Occidental/Brunswick Lode and The Silver City Spur. The Comstock Lode is an epithermal gold and silver deposit in a large fault system at the eastern base of the Virginia Range. The Occidental/Brunswick Lode is a gold and silver mineralized epithermal system in approximately 1.5 kilometers east of the main Comstock Lode and running parallel to it. The Silver City Spur is a branch of the Comstock Lode that runs southeast and connects with the southwestern splays of the Occidental Lode.

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.

China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring to materials with both civilian and military applications — to 20 Japanese companies, while placing another 20 groups on a new “watch list,” according to media reports.

Rare earth magnets are essential components in automobiles, electronics and defense systems, and global manufacturers remain heavily reliant on Chinese supply. The immediate export freeze applies to companies linked to defense-related work at Mitsubishi Heavy Industries (TSE:7011,OTCPL:MHVYF), Kawasaki Heavy Industries (TSE:7012,OTCPL:KWHIF), IHI (TSE:7013,OTCPL:IHICF) and NEC (TSE:6701,OTCPL:NIPNF).

Meanwhile, firms placed on the watch list will face slower shipments and must pledge “that the dual-use items will not be used for any purpose that contributes to enhancing Japan’s military capabilities.”

Items covered include critical minerals such as gallium, germanium, antimony and graphite, as well as rare earths, magnetic materials and certain advanced manufacturing equipment.

The dispute traces back to remarks in November last year by Prime Minister Sanae Takaichi, who said a hypothetical Chinese invasion of Taiwan could pose an “existential threat” to Japan and suggested Tokyo could respond with armed force. Beijing claims sovereignty over Taiwan and has warned it could use force if Taipei resists indefinitely.

The pressure also comes as Japan steps up efforts to reduce its dependence on China for rare earths. Earlier this month, Tokyo announced it had successfully retrieved mineral-rich seabed sediment from nearly 6,000 meters below the ocean near the remote island of Minamitorishima.

The material was recovered by the deep-sea drilling vessel Chikyu as part of a government-backed test program assessing the feasibility of mining rare-earths-bearing mud.

“It is a first step toward industrialization of domestically produced rare earth in Japan,” Takaichi said in a statement posted on X. “We will make efforts toward achieving resilient supply chains for rare earths and other critical minerals to avoid overdependence on a particular country.

China has used rare earths exports as leverage before.

In 2010, following a territorial dispute in the East China Sea, Beijing halted rare earths shipments to Japan, sending prices soaring and exposing Tokyo’s heavy reliance on Chinese supply.

The episode became a turning point for Japan’s resource strategy, accelerating efforts to diversify supply and directly supporting the rise of Australia’s Lynas Rare Earths (ASX:LYC,OTCQX:LYSDY), which has since grown into the largest rare earths producer outside China.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

“Copper Intelligence” (AFDG) “a dedicated copper exploration company, with a focus on creating value around Africa and DRC specifically focused on under-explored basins of copper ” (the “Company”) is pleased to announce that it has been invited to present on the Emerging Growth Conference for a business update on February 26, 2026 at 4.10pm EST, and invites individual and institutional investors as well as advisors and analysts, to attend its real-time, interactive presentation.

This live, interactive online event will give existing shareholders and the investment community the opportunity to interact with the Company’s Chairman, Andrew Groves as well as the Geological Director Aldo Cesano in real time.

Please register here to ensure you are able to attend the conference and receive any updates that are released.

https://goto.webcasts.com/starthere.jsp?ei=1717092&tp_key=1ddfafa563&sti=afdg

If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available on EmergingGrowth.com and on the Emerging Growth YouTube Channel, http://www.YouTube.com/EmergingGrowthConference. The company will release a link to that after the event.

About ‘ Copper Intelligence ‘

On Feb 4, 2026, African Discovery Group (AFDG), the predecessor company to Copper Intelligence, announced the signing of Definitive Sales and Purchase Agreement (SPA) for the Butembo Copper Asset in the Democratic Republic of Congo, in a Reverse Takeover Transaction (RTO), solidifying its status as the first stand-alone DRC company to be publicly traded in the United States. Butembo is a near surface, low strip, Tier one exploration opportunity, located near the Ruwenzori mountain location of Uganda’s biggest copper mine (Kilembe with 4 million tons of verified reserves), located only 50km from the Ugandan border with verified access to rail. The High-grade copper samples thus far have returned 18% Copper assays, which if maintained at production would rank amongst the highest globally. The recent discovery of the Butembo copper deposit has underscored the need for further exploration work in areas peripheral to the Katanga Copper Belt.

About the Emerging Growth Conference

The Emerging Growth conference is an effective way for public companies to present and communicate their new products, services and other major announcements to the investment community from the convenience of their office, in a time efficient manner. The Conference focus and coverage includes companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long term growth. Its audience includes potentially tens of thousands of Individual and Institutional investors, as well as Investment advisors and analysts. All sessions will be conducted through video webcasts and will take place in the Eastern time zone.

Disclosure:

This press release contains forward-looking statements. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to future exploration and production work in the Democratic Republic of Congo. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “forecasts,” “future,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements.

The company cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, and impacts, as well as those factors described in more detail under the heading “Risk Factors” in AFDG’s Annual Report on Form 10-K for the year ended February 28, 2026, to be filed with the U.S. Securities and Exchange Commission.

Investors are cautioned that many of the assumptions upon which AFDG’s forward-looking statements are based are likely to change after the date the forward-looking statements are made. Further, AFDG may make changes to its business plans that could affect its results. AFDG undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes.

Media Contact:

www.copperintelligence.com

Maxine Gordon

(917) 478-0406

Source

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.

The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of recent and ongoing drilling. This area forms the footprint of the planned Initial Mine, which is expected to be developed as an open pit.

Highlights

Charlie Long CEO commented:

“We are delivering strong, value-accretive progress at the Agadir Melloul and remain focused on advancing towards production as soon as practicable. The award of the Mining Licence is a major milestone and further underlines Morocco’s credentials as a supportive and attractive mining jurisdiction. I would like to thank our joint venture partner and the regional government for their continued support as we move into a busy and exciting period of delivery.”

|

Critical Mineral Resources plc Charles Long, Chief Executive Officer |

info@cmrplc.com |

|

Shard Capital LLP Erik Woolgar Damon Heath |

+44 (0) 207 186 9952 |

Notes To Editors

Critical Mineral Resources (CMR) PLC is an exploration and development company focused on developing assets that produce critical minerals for the global economy, including those essential for electrification and the clean energy revolution. Many of these commodities are widely recognised as being at the start of a supply and demand super cycle.

CMR is building a diversified portfolio of high-quality metals exploration and development projects in Morocco, focusing on copper, silver and potentially other critical minerals and metals. CMR identified Morocco as an ideal mining-friendly jurisdiction that meets its acquisition and operational criteria. The country is perfectly located to supply raw materials to Europe and possesses excellent prospective geology, good infrastructure and attractive permitting, tax and royalty conditions.

The Company is listed on the London Stock Exchange (CMRS.L). More information regarding the Company can be found at www.cmrplc.com

Source

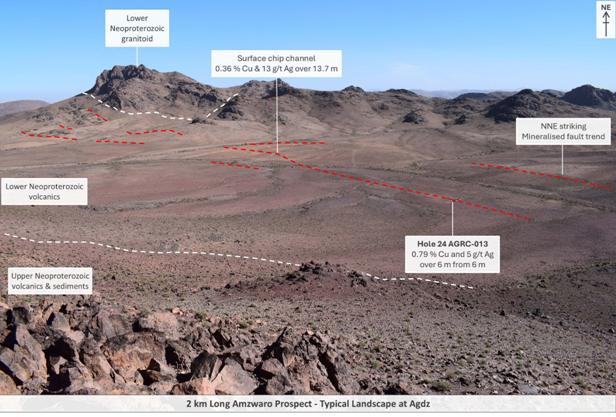

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it’s recently commissioned Environmental Impact Assessment (”EIA”) for the 100%-owned Agdz Mining Licence, part of the Agdz (‘Cu-Ag‘) Project (‘Agdz‘ or the ‘Project‘) in the Kingdom of Morocco (‘Morocco‘).

In the current global mining environment, the approval of the EIA represents a major regulatory milestone and materially de-risks the Project as Aterian advances toward systematic drilling and development readiness.

Highlights:

Charles Bray, Chairman of Aterian, commented:

‘Securing Moroccan EIA approval for the Agdz Mining Licence is a major step forward for Aterian. In a tightening global permitting environment, being regulatorily cleared to advance a copper project is a significant competitive advantage.

Our focus now shifts decisively to drilling for scale to develop this asset. The objective is clear: expand the mineralised footprint, build toward a defined resource base, and position Agdz as a development-ready copper asset in a jurisdiction with strong infrastructure and mining heritage. The integration of AI-driven geological modelling, through our partnership with Lithosquare, strengthens our targeting capability and enhances capital efficiency as we move into the next drilling phase.

With copper demand structurally rising and permitted projects increasingly scarce, Agdz represents a compelling opportunity. We are especially pleased to hear from existing shareholders seeking to participate in the recent equity placing, allowing the Company to allocate for expenditure to deliver sustained drilling news flow as we advance the Project over 2026.’

Strategic Importance

Permitted copper projects are increasingly scarce globally. With demand driven by electrification and the energy transition, projects capable of advancing without regulatory uncertainty are becoming strategically important.

EIA approval significantly strengthens Agdz’s development pathway and enhances its attractiveness to investors and potential strategic partners. The integration of AI-driven geological modelling through Lithosquare further positions Aterian to deploy capital efficiently and maximise discovery potential as drilling resumes.

Project Summary:

Aterian holds a 100% interest in the 50.4 km² Agdz Copper-Silver Project, comprising the 34.5 km² Agdz licence and the adjacent 15.9 km² Agdz Est licence in central Morocco.

The Project is located in the highly prospective Anti-Atlas Mountains within the Drâa Tafilalet region, approximately 35 km east of Ouarzazate, a well-serviced regional hub with an airport and established infrastructure. The Project benefits from excellent access via paved and unpaved roads. It is situated approximately 40 km southeast of the Noor solar power complex, one of the world’s largest renewable energy facilities.

Agdz is located within Morocco’s highly prospective Anti-Atlas belt, a stable and well-established mining jurisdiction with growing strategic importance for copper supply.

The Agdz Project is situated within a well-established copper-silver mining district, approximately 14 km southwest of the Bouskour copper-silver mine (19 Mt at 1.44 % Cu and 12 g/t Ag Measured & Indicated and 9 Mt at 1.61 % Cu Proven & Probable1) and within trucking distance of existing mining infrastructure. The world-class Imiter silver mine (192 M Oz Ag Measured & Indicated and 152 M Oz Ag Proven & Probable2) lies approximately 80 km northeast of the Project, with both operations owned by Managem Group. While mineralisation at neighbouring deposits is not necessarily indicative of mineralisation at Agdz, their presence underscores the district-scale prospectivity of the Anti-Atlas Belt.

1 Source: Managem Group – Bouskour project (managemgroup.com). May not be reported in accordance with compliant reporting requirements.

2 Source: Managem Group – Imiter mine (managemgroup.com). May not be reported in accordance with compliant reporting requirements.

|

|

Illustrations

The following figures/images have been prepared by Aterian and relate to the disclosures in this announcement.

Issue of Equity and Funding

The Company also announces, following on from the announcement dated 19 February 2026, that it has raised an additional £100,000 from existing investors through a subscription for 400,000 new ordinary shares (‘Subscription Shares‘) at a price of 25 pence per Subscription Share and the issue of an additional 112,000 shares to the Employee Benefit Trust (‘EBT Shares‘). Subscribers to the Subscription Shares will also receive 200,000 warrants (the ‘Warrants‘), or 50% warrant coverage, with each Warrant exercisable at a strike price of 32.5 pence per ordinary share. The Warrants will have a maturity date of 15 February 2028 and a call feature should the Company’s closing mid-price exceed 50 pence for three consecutive trading days. A further total of 88,000 new ordinary shares have been issued in lieu of fees to a service provider (‘Fee Shares‘).

An application will be made for the Subscription Shares, the EBT Shares and the Fee Shares (together the ‘New Shares‘) to be admitted to trading on the London Stock Exchange, with admission expected to occur on or around 03 March 2026 (‘Admission‘). Following the issue of the New Shares, the Company’s enlarged issued share capital will comprise 17,684,000 Ordinary Shares.

This figure of 17,684,000 represents the total voting rights in the Company and should be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in the Company under the Financial Conduct Authority’s Disclosure Guidance & Transparency Rules.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Simon Rollason, Chief Executive Officer of Aterian Plc. A graduate of the University of the Witwatersrand in Geology (Hons). He is a Member of the Institute of Materials, Minerals and Mining, with over 30 years of experience in mineral exploration and mining.

– ENDS –

This announcement contains information which, prior to its disclosure, was inside information as stipulated under Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310 (as amended).

Engage directly with the Aterian PLC management team by asking questions, watching video summaries, and seeing what other shareholders have to say. Please navigate to our interactive investor hub here: https://aterianplc.com/s/fcf8eb

For further information, please visit the Company’s website: www.aterianplc.com or contact:

Aterian Plc:

Charles Bray, Executive Chairman – charles.bray@aterianplc.com

Simon Rollason, CEO & Director – simon.rollason@aterianplc.com

Financial Adviser and Joint Broker:

AlbR Capital Limited

David Coffman / Dan Harris

Tel: +44 (0)207 7469 0930

Joint Broker:

SP Angel Corporate Finance LLP

Ewan Leggat / Devik Mehta

Tel: +44 20 3470 0470

Financial PR:

Bald Voodoo – ben@baldvoodoo.com

Ben Kilbey

Tel: +44 (0)7811 209 344

Subscribe to our news alert service: https://atn-l.investorhub.com/auth/signup

Notes to Editors:

About Aterian plc

www.aterianplc.com

Aterian plc is an LSE-listed exploration and development company with a diversified African portfolio of critical metals projects.

Aterian plc is actively seeking to acquire and develop new critical metal resources to strengthen its existing asset base while supporting ethical and sustainable supply chains as the world transitions to a sustainable, renewable future. The supply of these metals is vital for developing the renewable energy, automotive, and electronic manufacturing sectors, which are increasingly important in reducing carbon emissions and meeting global climate ambitions.

Aterian has a portfolio of multiple copper-silver (+gold) and base-metal projects in Morocco. Aterian holds a 90% interest in Atlantis Metals, a private Botswana-registered company holding eleven mineral prospecting licences for copper-silver in the world-renowned Kalahari Copperbelt and three for lithium and salt brine exploration in the Makgadikgadi Pans region. The Company also holds an exploration licence in southern Rwanda, where it is evaluating the tantalum and niobium opportunity, in addition to further exploring for pegmatite-hosted lithium.

The Company’s strategy is to seek new exploration and production opportunities across the African continent and to develop new sources of critical mineral assets for exploration, development, and trading.

Glossary of Terms

The following is a glossary of technical terms:

|

‘Ag’ |

means |

Silver |

|

‘Au’ |

means |

Gold |

|

‘Breccia’ |

means |

a rock consisting of angular fragments of stones cemented by finer materials |

|

‘Cu’ |

means |

Copper |

|

‘Ferruginous’ |

means |

containing iron oxides |

|

‘Float sample’ |

means |

loose pieces of rock that are not connected to an outcrop |

|

‘g/t’ |

means |

grams per tonne |

|

‘Hercynian or Variscan Orogeny’ |

means |

an orogenic belt that evolved during the Devonian and Carboniferous periods, from about 419 to 299 million years ago |

|

‘km’ |

means |

Kilometres |

|

‘m’ |

means |

Metres |

|

‘mm’ |

means |

Millimetres |

|

‘Mt’ |

means |

millions of tonnes |

|

‘NI 43-01’ |

means |

National Instrument 43-101 Standards of Disclosure of Mineral Projects of the Canadian Securities Administrators |

|

‘Outcrop’ |

means |

a rock formation that is in situ and visible on the surface |

|

‘Qualified Person’ |

means |

a person that has the education, skills and professional credentials to act as a qualified person under NI 43-101 |

|

‘Sb’ |

means |

Antimony is used in alloys and in lead-acid storage batteries. The U.S. government has considered antimony a critical mineral mainly because of its use in military applications. |

|

‘Stratiform’ |

means |

parallel to the bedding planes of the surrounding rock |

|

‘Vein’ |

means |

a distinct sheetlike body of crystallised minerals within a rock |

|

‘Zn’ |

means |

Zinc |

Source