Sun Summit Minerals Corp. (TSXV: SMN) (OTCQB: SMREF) (‘Sun Summit’ or the ‘Company’) is pleased to report assay results from all 2025 drilling at the Finn Zone of its JD Project in the Toodoggone Mining District, north-central British Columbia. 2025 drill results will be integrated into an updated 3D model and will inform the fully funded 10,000 meter drill program planned for 2026.

Drill hole FZ-25-002 returned a significant interval of near-surface gold-silver mineralization: 46.0 meters of 1.03 g/t gold with 44.9 g/t silver from 38.0 meters down hole, including 6.0 meters of 5.30 g/t gold with 157.9 g/t silver from 60.0 meters down hole. This interval is punctuated with a 1.0-meter zone that returned 784.0 g/t silver, highlighting the high-grade and historically overlooked silver potential of the Finn zone epithermal-related system.

Highlights:

- Drill hole FZ-25-002 investigated the gold-silver mineralization potential of the Finn Zone and evaluated the structural controls on the high-grade silver component. The drill hole intersected a broad zone of near-surface gold-silver mineralization punctuated with high-grade gold and silver veins and hydrothermal breccias:

- 46.0 meters of 1.03 g/t gold with 44.9 g/t silver from 38.0 meters downhole, including

- 17.0 meters of 2.31 g/t gold with 113.1 g/t silver from 49.0 meters downhole, and including

- 6.0 meters of 5.30 g/t gold with 157.9 g/t silver from 60.0 meters downhole

- high-grade gold-silver intercepts of:

- 447 g/t silver with 0.93 g/t gold over 1.0 meter at 53.0 meters down hole

- 19.75 g/t gold with 80.90 g/t silver over 1.0 meter at 60.0 meters down hole

- 784 g/t silver with 6.79 g/t gold over 1.0 meter at 65.0 meters down hole

- Confirms the strong high-grade gold-silver potential of the Finn Zone: Numerous high-grade intercepts in drill holes FZ-25-002 and FZ-25-001 (e.g., 273 g/t silver with 2.6 g/t gold over 0.51 meters at 38.3 meters downhole and 22.9 g/t gold with 29.0 g/t silver over 0.50 meters at 65.0 meters downhole, (Table 1) demonstrate the high-grade potential of the target. Additional drilling and modelling focused on the structural controls on the silver-rich zones are planned for follow-up drill programs.

- Strong gold-silver mineralization intersected in FZ-25-004 confirms the expansion potential of the Finn Zone down-dip. The drill hole investigated the down-dip extent of bulk-tonnage style mineralization of the Finn Zone and intersected multiple zones of mineralization including a strong interval of gold-silver mineralization approximately 160 meters down-dip from FZ-25-002 (15.8 meters of 1.17 g/t gold with 9.12 g/t silver from 104.0 meters downhole, including 7.0 meters of 1.72 g/t gold with 15.3 g/t silver from 111.0 meters downhole).

- Strong porphyry-related alteration intersected in two reconnaissance drill holes at the Belle South target: Zones of intense phyllic and local potassic alteration overprinting polymictic breccias suggest proximity to a robust porphyry-copper system. The +8.5 km trend of significant hydrothermal alteration coincident with IP and magnetic anomalies is considered strongly prospective for porphyry-related mineralization. Significant exploration across the JD Porphyry trend is planned for 2026.

‘Results from our late-season, modest, four drill hole program at the Finn Zone in 2025 have exceeded expectations and firmly establish the zone as a high-priority target for significant drilling in 2026. The presence of both high-grade and near-surface bulk-tonnage style gold-silver mineralization with strong continuity positions the target as an area for significant drilling in 2026,’ said Niel Marotta, CEO of Sun Summit Minerals. ‘We are fortunate to have growing institutional investor support and Sun Summit is fully funded for its 2026 drill program after closing an oversubscribed $11.5 million private placement in December 2025. Planning is underway for a considerable follow-up resource-focused drill program, with a minimum 10,000 meters of drilling expected. The 2026 program would exceed the 9,400 meters of cumulative drilling completed by Sun Summit in 2024 and 2025, and further adds to the 36,000 meters of historic drilling at JD prior to 2024. The focus of the 2026 drill program will be at the Creek to Finn Corridor, and drill results will contribute to an inaugural mineral resource estimate expected by Q2 2027.’

Table 1. Assay Results for 2025 Finn Zone Drill Holes

| Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

| FZ-25-001 |

29.00 |

69.00 |

40.00 |

1.18 |

21.1 |

|

| including |

35.00 |

42.00 |

7.00 |

0.88 |

39.8 |

|

| including |

38.30 |

38.81 |

0.51 |

2.60 |

237.0 |

|

| including |

58.00 |

69.00 |

11.00 |

3.37 |

28.5 |

|

| including |

65.00 |

65.50 |

0.50 |

22.90 |

29.0 |

|

| and |

107.00 |

111.00 |

4.00 |

2.13 |

2.7 |

|

| and |

121.00 |

124.00 |

3.00 |

0.70 |

1.3 |

|

| and |

175.50 |

179.00 |

3.50 |

1.14 |

2.3 |

|

|

|

|

|

|

|

|

| FZ-25-002 |

26.00 |

32.00 |

6.00 |

0.35 |

16.6 |

|

| and |

38.00 |

84.00 |

46.00 |

1.03 |

44.9 |

|

| including |

49.00 |

66.00 |

17.00 |

2.31 |

113.1 |

|

| including |

53.00 |

54.00 |

1.00 |

0.93 |

447.0 |

|

| including |

60.00 |

66.00 |

6.00 |

5.30 |

157.9 |

|

| including |

60.00 |

61.00 |

1.00 |

19.75 |

80.9 |

|

| including |

65.00 |

66.00 |

1.00 |

6.79 |

784.0 |

|

| and |

144.00 |

148.00 |

4.00 |

1.77 |

0.3 |

|

| and |

193.00 |

197.00 |

4.00 |

0.79 |

3.6 |

|

|

|

|

|

|

|

|

| FZ-25-003 |

101.10 |

110.00 |

8.90 |

0.44 |

2.2 |

|

| and |

137.00 |

145.00 |

8.00 |

0.39 |

1.2 |

|

| and |

220.00 |

225.54 |

5.54 |

0.33 |

5.5 |

|

|

|

|

|

|

|

|

| FZ-25-004 |

44.41 |

56.20 |

11.79 |

0.83 |

1.0 |

|

| including |

53.00 |

56.20 |

3.20 |

1.87 |

2.4 |

|

| and |

96.00 |

98.00 |

2.00 |

7.54 |

0.7 |

|

| and |

104.00 |

119.80 |

15.80 |

1.17 |

9.1 |

|

| including |

111.00 |

118.00 |

7.00 |

1.72 |

15.3 |

|

Notes:

- Intervals are downhole core lengths. True widths are unknown.

- Calculations are uncut and length-weighted using a 0.10 g/t gold cut-off.

- Grades have not been capped in the length-weighted averaging.

|

|

2025 Finn Zone Drill Program

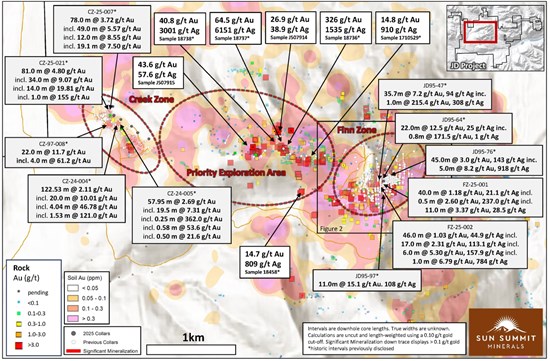

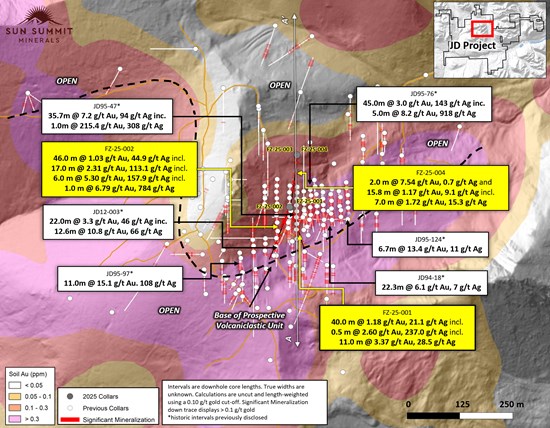

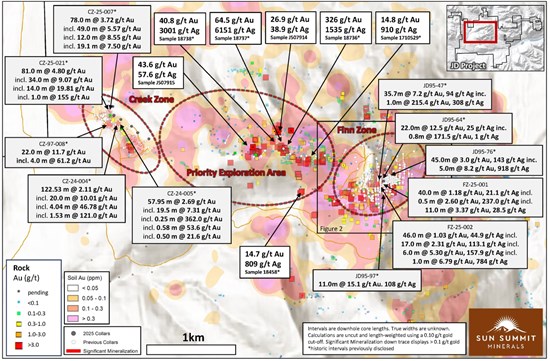

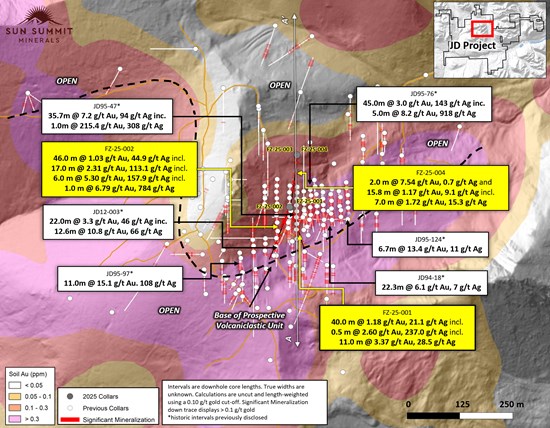

Four drill holes, totalling 950 meters were completed at the Finn Zone in 2025 (Figure 2 and Table 2). The epithermal-related, gold-silver zone is approximately 3.5 kilometers east of the Creek Zone (e.g., 81.0 meters of 4.8 g/t gold, see November 25th, 2025 news release) and marks the eastern extent of the highly-prospective 4.5 kilometer long, Creek to Finn corridor (Figure 1). The drill holes were designed to investigate the continuity of near-surface, high-grade gold-silver mineralization and the down-dip extent of bulk-tonnage mineralization intersected in previous drill programs (e.g., 35.7 meters of 7.26 g/t gold, 94 g/t silver including 1.0 meters of 215.4 g/t gold, 308 g/t silver in JD95-0472 and 20.85 meters of 8.76 g/t gold, 68 g/t silver including 11.0 m of 15.1 g/t gold,108 g/t silver in JD95-0972, Figure 2). Extensive modelling of compiled historical Finn zone drill data outlined a compelling zone of strong silver-rich mineralization (e.g., 45.0 m of 3.02 g/t Au, 136 g/t Ag including 5.0 meters of 8.18 g/t gold, 918 g/t silver in JD95-0762). Drilling in 2025 also focused on evaluating the structural and/or lithological controls on this gold-associated, silver-rich mineralization.

Highlights from 2025 Finn Zone Drilling include:

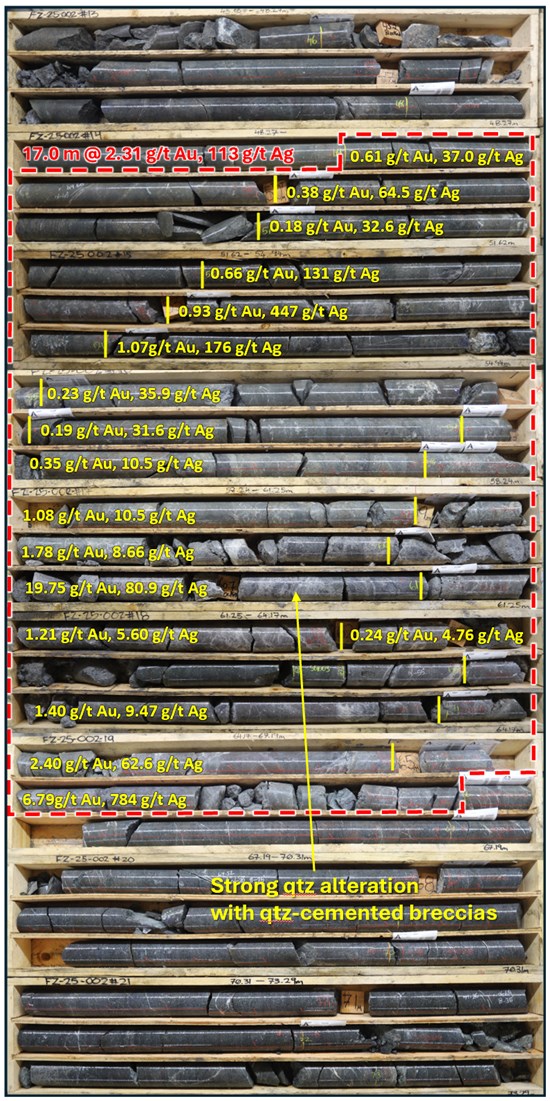

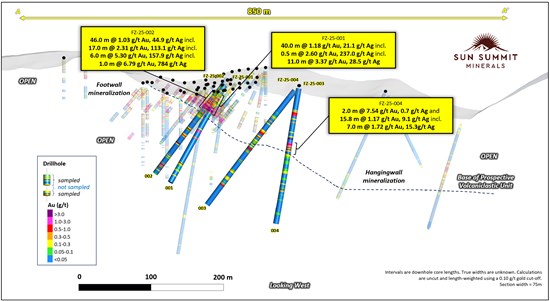

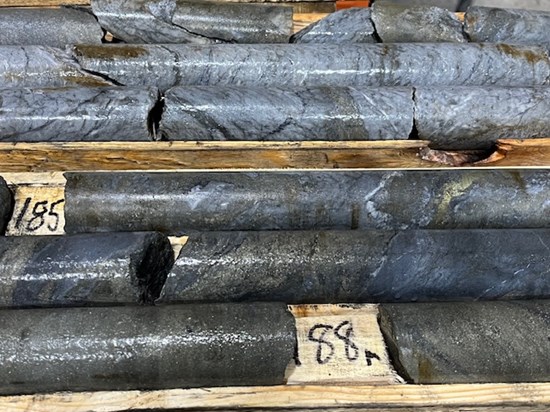

- Drill holes FZ-25-001 and FZ-25-002 successfully confirmed the near-surface bulk-tonnage and the high-grade gold-silver potential of the Finn Zone. Drill hole FZ-25-002 intersected a broad zone of near-surface gold-silver mineralization punctuated with high-grade gold and silver veins and hydrothermal breccias (e.g., 46.0 meters of 1.03 g/t gold with 44.9 g/t silver from 38.0 meters downhole, including, 17.0 meters of 2.31 g/t gold with 113.1 g/t silver, Figure 2 and Table 1). The main interval consists of numerous, local high-grade veins and breccias (e.g., 447 g/t silver with 0.93 g/t gold over 1.0 meter, 19.75 g/t gold with 80.90 g/t silver over 1.0 meter and 784 g/t silver with 6.79 g/t gold over 1.0 meter). Based on gold-silver ratios it appears the high-silver domains represent a different pulse of mineralization. Further modelling and follow-up drilling is required to define the extents of this high-silver domain.

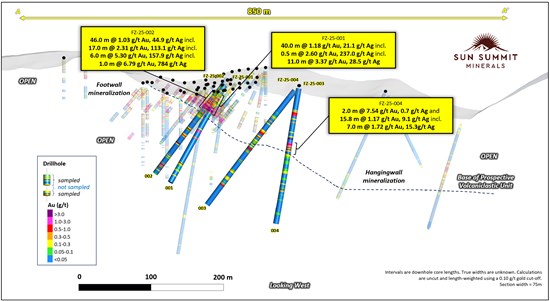

- Drill holes FZ-25-003 and FZ-25-004 were step-out holes designed to test the dip-extent of mineralization along the gently north-dipping zone of volcanic breccias (Figure 3). Drill hole FZ-25-004 intersected multiple zones of gold-silver mineralization (e.g., 15.8 meters of 1.17 g/t gold with 9.12 g/t silver, including 7.0 meters of 1.72 g/t gold with 15.30 g/t silver, Figure 3, Table 1) typical of the core of the Finn Zone. This zone of strong mineralization in FZ-25-004 is approximately 160 meters downdip from FZ-25-002 (Figure 3). Mineralization intersected in FZ-25-004 confirms the expansion potential of the Finn Zone down-dip.

Finn Zone Geology

Most of the historical drilling (over 300 drill holes) at the JD Project was focused on the Finn zone where a broad zone of near-surface, epithermal-related gold-silver mineralization was defined (Figure 1). Mineralization is primarily hosted in the hanging wall of a gently north-dipping, northeast-striking, locally faulted volcaniclastic unit. The volcaniclastic unit, traced for over 1.5 kilometres along strike to the west from the Finn zone, separates two andesite-dominant lithological units of the Toodoggone Formation (Metsantan and McClair members). Faulting and subsequent mineralization likely exploited a volcaniclastic unit, at the base of the Metsantan member, where epithermal-related fluids were focused along permeable volcanic breccias.

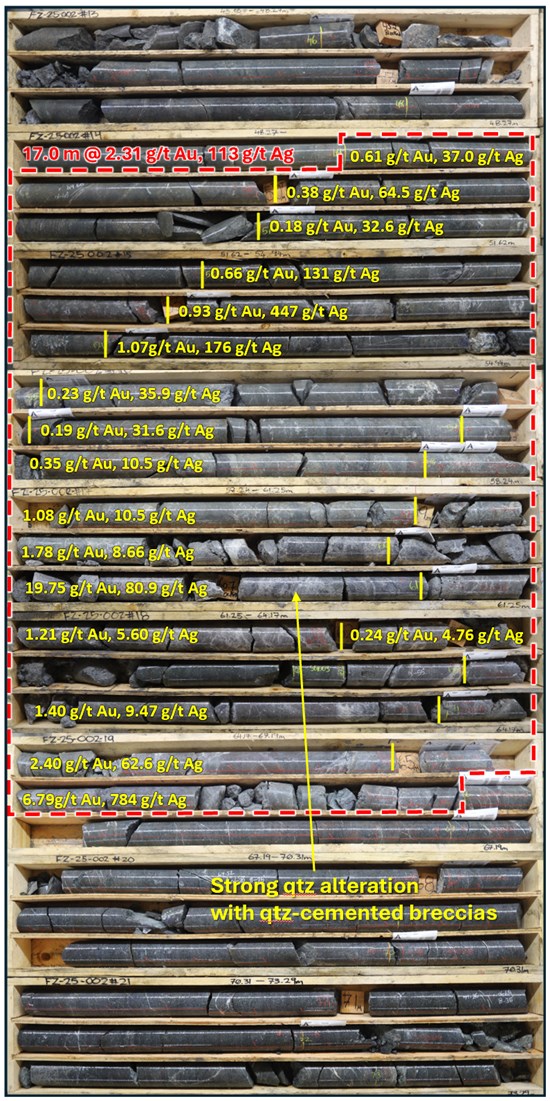

The core of the Finn zone consists of strongly silica+clay+sericite altered polymictic breccias, locally cemented with quartz and mineralized with pyrite with lesser sphalerite, galena, and chalcopyrite. Peripheral to the high-grade core, epithermal-related alteration grades into sericite+chlorite+pyrite and more distal epidote+chlorite+/-hematite assemblages with elevated base-metal mineralization.

Next Steps: Creek to Finn Corridor

Assay and geological data from the 2025 Finn Zone drill program are currently being integrated into an updated 3D structural and mineralization model for the target area. The results from the modelling will inform the next phase of drilling set to commence this summer.

The focus of the significant drill program at the 4.5 km Creek to Finn Corridor will be on targeting the extents of mineralization at the Creek and Finn zones. Drill results will contribute to an inaugural mineral resource estimate. Details of the summer 2026 JD drill program will be announced once plans and budgets are set.

Figure 1. Plan map highlighting the 4.5 km Creek to Finn Corridor showing drill collar locations of all 2025 Creek and Finn zone drill holes and historical drill collars as well as results from recent and historical rock and soil geochemical surveys (see October 29th, 2025 news release). The area between the Finn and Creek zones will be a focus for 2026 exploration programs. See references 1 and 2 for sources of historical drill data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_002full.jpg

Figure 2. Plan map of the Finn Zone showing 2025 collars and all historical drill collars with selected highlights. See references below for sources of historical data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_003full.jpg

Figure 3. Cross section through drill holes FZ-25-001, 002, 003 and 004 showing down hole assay data. Selected highlights from historical drill programs are also shown. See references below for sources of historical drill data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_004full.jpg

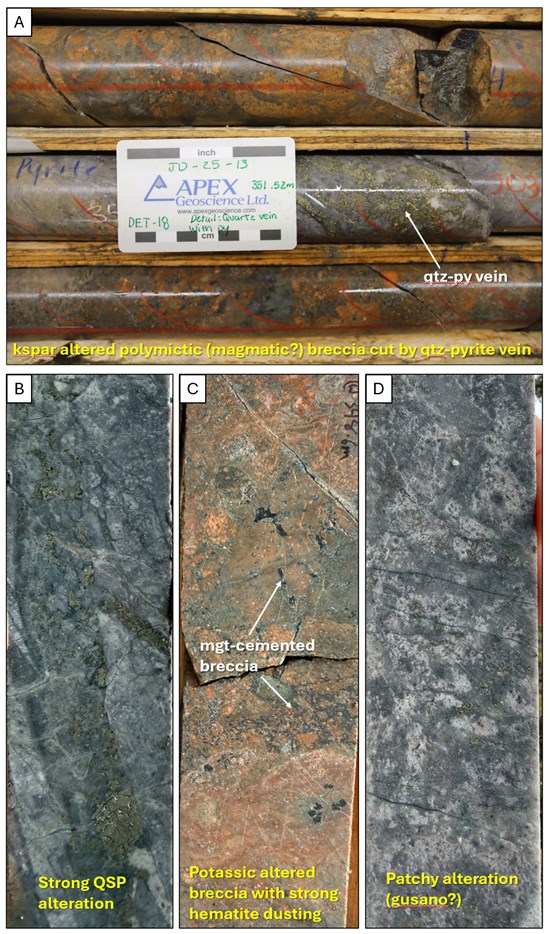

Figure 4. Core photos of FZ-25-002. Box photos showing core from 45.65 meters to 73.29 meters downhole which includes a broad interval of 17.0 meters of 2.31 g/t gold with 113.1 g/t silver. Individual down hole gold and silver assay results are annotated at the sample depths. The interval consists of strongly silicified andesite transitioning to quartz-cemented hydrothermal breccias. Abbreviations, qtz = quartz

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_005full.jpg

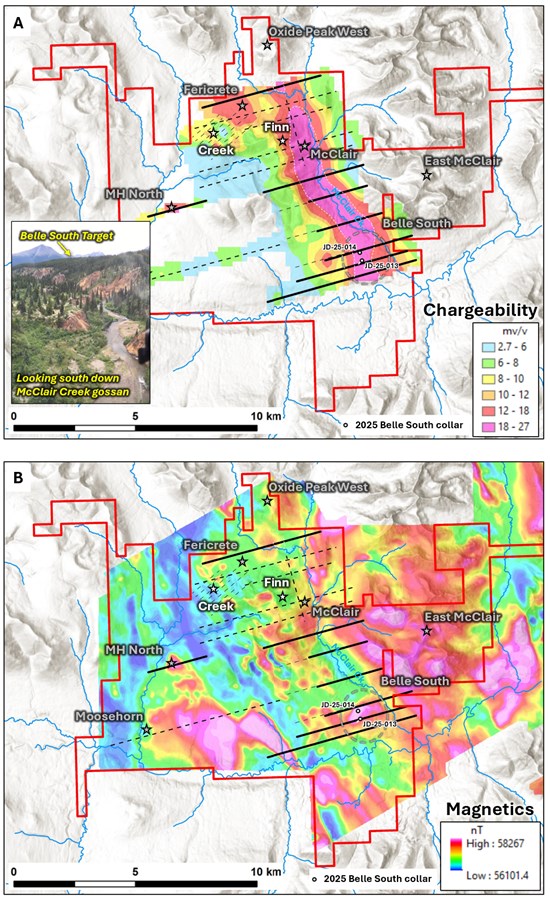

Belle South Porphyry Target

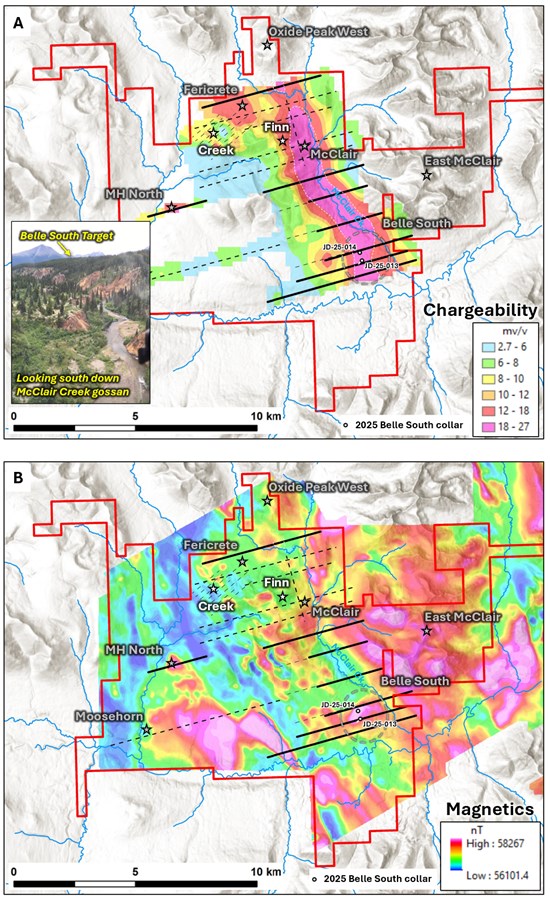

Two drill holes for 811 meters in 2025 evaluated the recently defined and previously untested Belle South Porphyry target (see September 18th, 2025 news release, Figure 5). The two drill holes focused on coincident magnetic-high and high-chargeability anomalies near the southern extent of the McClair Creek alteration zone (Figure 5). The purpose of the two short holes was to test for porphyry-related alteration and mineralization in an area largely covered by till.

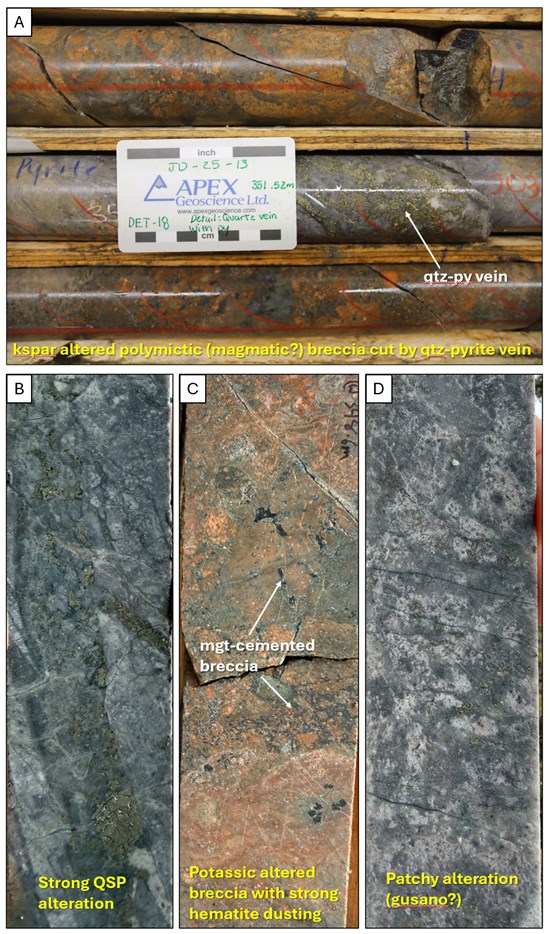

The first hole, JD-25-013, collared in rubbly and pervasively QSP (quartz-sericite-pyrite, phyllic assemblage) altered andesite which transitioned to a broad zone of intermediate volcaniclastic rocks (crystal to lapilli tuffs) to bottom of hole. The breccias are locally potassic (potassium feldspar-magnetite) altered and cut by zones of intense phyllic alteration (Figure 6). The breccias locally contain altered intrusive clasts and intervals with hydrothermal magnetite cement (Figure 6). Phyllic alteration with strong disseminated pyrite (up to 20%) persisted throughout the hole with an increase in argillic assemblages with possible gusano textures near the bottom of the hole.

Drill hole JD-25-014 tested the core of the magnetic-high and collared in porphyritic quartz monzodiorite with increasing propylitic (epidote-chlorite) alteration with local pervasive potassium feldspar alteration to bottom of hole. The monzodiorite is weakly to moderately magnetic.

The lithologies and alteration assemblages intersected in both holes suggest proximity to a porphyry-related copper system. The holes returned weakly anomalous zones of copper mineralization with geochemical data suggesting the holes intersected distal alteration assemblages (e.g., elevated zinc). The two holes tested only a small portion of the 8.5 km by 2 km long JD Porphyry trend. Only five drill holes have previously investigated the porphyry-copper potential of the trend, all focused 5 km north at the McClair target near the epithermal-related Finn Zone (see February 5th, 2025 news releases). Similar to the McClair target, the Belle South target warrants significantly more drilling to fully evaluate the porphyry potential of the compelling target area.

Details of the 2026 porphyry-focused exploration program at JD will be announced once all surface data (e.g., rock and soil geochemistry and hyperspectral) have been interpreted together with all geophysical data-sets (e.g., IP, magnetics). A program of continued geophysical surveys, geological mapping and drilling is anticipated.

Figure 5. JD Porphyry Trend, A. Map of the JD Project showing the recently compiled IP data (400m depth slice through the chargeability model, see September 18th, 2025 news release). Key targets are highlighted including the Belle South target. Collar locations for the two 2025 reconnaissance drill holes are shown. Inset photo looking south down McClair Creek showing parts of the 10 km long McClair Creek gossan. The Belle South porphyry target is situated above the gossan on a till covered plateau, where the coincident high-chargeability and high-magnetic intensity is located. B. Map of the JD Project showing total magnetic intensity data acquired in 2021 overlain with IP lines and key target areas. Collar locations for the two 2025 reconnaissance drill holes are shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_006full.jpg

Figure 6. Representative core photos of JD-25-013, the first drillhole to test the Belle South porphyry target. A. Potassium feldspar altered polymictic breccia cut by quartz-pyrite vein. The reddening is caused by weak to moderate potassium feldspar alteration and hematite dusting of feldspars, B. representative core photo of pervasive phyllic alteration (QSP), C. magnetite cemented breccia, B. texture destructive alteration showing possible gusano texture near the bottom of the hole. Abbreviations, kspar = potassium feldspar, QSP = quartz-sericite-pyrite, mgt = magnetite, qtz = quartz, py = pyrite

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_007full.jpg

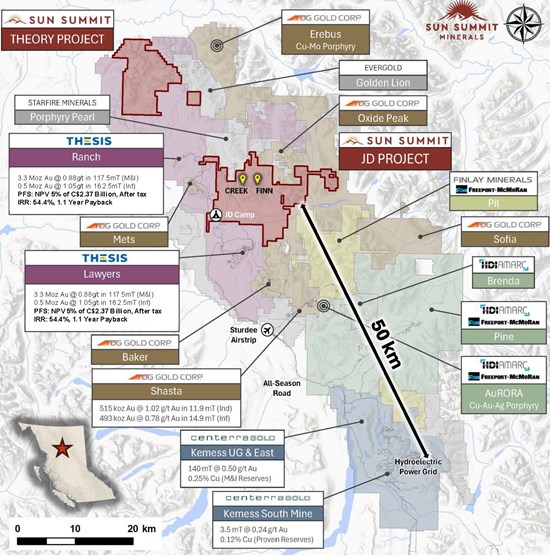

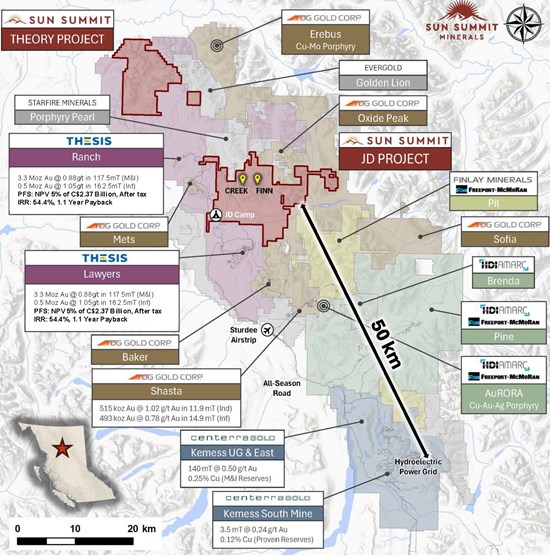

Figure 7. Map of the Toodoggone District showing the location of the JD Project in relation to other development and exploration projects. Data sourced from Thesis Gold Inc., TDG Gold Corp. and Centerra Gold Inc.’s respective corporate websites. The QP has been unable to verify the information and that the information is not necessarily indicative to the mineralization on the property that is the subject of the disclosure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6142/281199_a90dc3c604b29a4c_008full.jpg

Table 2. Drill Collar Information

| Hole ID |

Easting |

Northing |

Elevation (m) |

Azimuth |

Dip |

Depth (m) |

| FZ-25-001 |

611231 |

6367672 |

1792 |

160 |

-60 |

215 |

| FZ-25-002 |

611231 |

6367672 |

1793 |

200 |

-48 |

215 |

| FZ-25-003 |

611248 |

6367800 |

1782 |

188 |

-50 |

269 |

| FZ-25-004 |

611248 |

6367800 |

1782 |

188 |

-80 |

251 |

| JD-25-013 |

614642 |

6363128 |

1295 |

225 |

-65 |

485 |

| JD-25-014 |

614550 |

6363450 |

1307 |

45 |

-80 |

326 |

| Coordinates are in UTM NAD83 Zone 9N |

Quality Assurance and Quality Control

All drill core sample assay and analytical results have been monitored through the Company’s quality assurance and quality control program (QA/QC). Drill core was sawn in half at Sun Summit’s dedicated and secure core logging and processing facility at the JD exploration camp.

Half of the drill core was sampled and shipped by a bonded courier in sealed and secured woven polyester bags to the ALS Global preparation facilities in Kamloops, BC. Core samples were prepared using ALS standard preparation procedure PREP-31A which involves crushing the sample to 70% less than 2mm, followed by a riffle split of 250g, and then a pulverised split to better than 85% passing 75 microns.

Following sample preparation, the pulps were sent to the ALS Global analytical laboratory in North Vancouver, B.C. for analysis. ALS Global is registered to ISO/IEC 17025:2017 accreditations for laboratory procedures.

Drill core samples were analyzed for 48 elements by ICP-MS on a 0.25-gram aliquot using a four-acid digestion (method ME-MS61). This method is considered a ‘ultra trace element’ analytical method with low detection limits on key pathfinder elements such as Ag, As, Sb, Se and Tl.

Gold was analyzed by fire assay on a 30-gram aliquot with an AES finish (inductively coupled plasma atomic emission spectroscopy – method Au-ICP21). Samples that returned >10 parts per million (ppm) gold were re-analyzed by fire assay using a gravimetric finish on a 30-gram aliquot (method Au-GRA21).

Overlimit samples (e.g. Ag, Cu, Pb & Zn) were re-analyzed using an ore-grade, four-acid digestion and ICP-AES finish. Over limits for key elements: samples with >100 ppm silver, >10,000 ppm Cu, >10,000 ppm Pb and >10,000 ppm Zn.

In addition to ALS Global laboratory QA/QC protocols, Sun Summit implements a rigorous internal QA/QC program that includes the insertion of duplicates, certified reference materials (standards prepared by an independent lab) and blanks into the sample stream.

A total of 69 QA/QC samples, including 48 standards, were inserted in the field for all Finn Zone drill holes, representing 12.7% of the overall sample stream. There were no significant issues identified in either the internal or external QA/QC samples.

National Instrument 43-101 Disclosure

This news release has been reviewed and approved by Sun Summit’s Vice President Exploration, Ken MacDonald, P. Geo., a ‘Qualified Person’ as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. Mr. MacDonald has verified the data disclosed in this press release, including the sampling, analytical and test data underlying this information that has been collected by Sun Summit. Verification procedures include industry standard quality control practices. Some technical information contained in this release is historical in nature and has been compiled from public sources believed to be accurate. The historical technical information has not been verified by Sun Summit and may in some instances be unverifiable dependent on the existence of historical drill core and grab samples. Management cautions that past results are not necessarily indicative of the results that may be achieved on the property.

Community Engagement

Sun Summit is engaging with First Nations on whose territory our projects are located and is discussing their interests and identifying contract and work opportunities, as well as opportunities to support community initiatives. The Company looks forward to continuing to work with local and regional First Nations with ongoing exploration.

About the JD Project

The JD Project is located in the Toodoggone mining district in north-central British Columbia, a highly prospective deposit-rich mineral trend. The project covers an area of over 15,000 hectares and is in close proximity to active exploration and development projects, such as Thesis Gold’s Lawyers and Ranch projects, TDG Gold’s Baker-Shasta projects, Amarc Resource’s AuRORA project, Centerra’s Gold’s Kemess East and Underground projects, as well as the past-producing Kemess open pit copper-gold mine (Figure 5).

The project is 450 kilometres northwest of the city of Prince George, and 25 kilometres north of the Sturdee airstrip. It is proximal to existing infrastructure in place to support the past-producing Kemess mine, including roads and a hydroelectric power line.

The JD Project is in a favourable geological environment characterized by both high-grade epithermal gold and silver mineralization, as well as porphyry-related copper and gold mineralization. Some historical exploration, including drilling, geochemistry and geophysics, has been carried out on the property, however the project area is largely underexplored.

About Sun Summit

Sun Summit Minerals (TSXV: SMN) (OTCQB: SMREF) is a mineral exploration company focused on the discovery, expansion and advancement of district scale gold and copper assets in British Columbia. The Company’s diverse portfolio includes the JD and Theory projects in the Toodoggone region of north-central B.C., and the Buck Project in central B.C.

Further details are available at www.sunsummitminerals.com.

References

- Hawkins, P.A. (1998), 1997 Exploration Report on the Creek Zone for Antares Mining and Exploration Corporation and AGC Americas Gold Corporation, JD Property, Toodoggone River Area, Omineca Mining Division, Internal Report #98-065-1.

Link to Figures

Figure 1: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure1_SMN_JD_Finn_All-scaled.jpg

Figure 2: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure2_SMN_JD_Finn_All-scaled.jpg

Figure 3: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure3_SMN_JD_Finn_CrossSection-scaled.jpg

Figure 4: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure4_SMN_JD_CZ-002_CorePhotos-scaled.jpg

Figure 5: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure5_SMN_JD_BS_Holes-scaled.jpg

Figure 6: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260122_Figure6_SMN_JD-25-013_CorePhotos-scaled.jpg

Figure 7: https://wp-sunsummitminerals-2024.s3.ca-central-1.amazonaws.com/media/2026/01/20260121_Figure1-Toodoggone-map.jpg

On behalf of the board of directors

Niel Marotta

Chief Executive Officer & Director

info@sunsummitminerals.com

For further information, contact:

Matthew Benedetto, Simone Capital

mbenedetto@simonecapital.ca

Tel. 416-817-1226

Forward-Looking Information

This news release contains ‘forward-looking information’ within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as ‘expects’, or ‘does not expect’, ‘is expected’, ‘interpreted’, ‘management’s view’, ‘anticipates’ or ‘does not anticipate’, ‘plans’, ‘budget’, ‘scheduled’, ‘forecasts’, ‘estimates’, ‘potential’, ‘feasibility’, ‘believes’ or ‘intends’ or variations of such words and phrases or stating that certain actions, events or results ‘may’, ‘could’, ‘would’, ‘might’ or ‘will’ be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains the forward-looking information pertaining to, among other things: the significance of the assay results reported at Finn Zone, JD Project; the size and timing of the 2026 drill program at the JD project, and the focus areas thereof; the contribution of results, if any, from the 2026 drill program to an inaugural mineral resource estimate and timing thereof; the Finn Zone constituting or remaining a priority target for the 2026 drill program, if at all; the availability and sufficiency of funding to complete the 2026 drill program as planned; future use of assay and geological data from the 2025 Finn Zone drill program, if any for purposes of the next phase of drilling, and timing thereof; the future focus of the drill program at the Finn to Creek Corridor; timing of announcement of details of the summer 2026 JD drill program, if any; the prospects, if any, of the JD Project; the size and timing of future exploration activities, including drilling, at the JD Project; the significance and reliability of historic exploration activities and results; the ability of exploration activities to predict mineralization; the ability of mineralization to be extracted on favourable economic terms; the reliability of a 3D geological and structural model; the results of the selection of samples from 2024 and 2025 drilling sent to the ALS Global analytical facility; the results of any community engagement activities; the JD Project being on a deposit-rich mineral trend; property, royalty, option and other similar property interests.

Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, Sun Summit cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Sun Summit nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of Sun Summit to complete further exploration activities, including drilling; property, option and royalty interests in the JD Gold Project; the ability of the Company to obtain required approvals; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Sun Summit does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with Sun Summit Minerals (TSXV:SMN,OTCQB:SMREF) to receive an Investor Presentation

Source

This post appeared first on investingnews.com

computational engine to collapse that latency.

computational engine to collapse that latency.