Metro Mining (MMI:AU) has announced Appendix 4E

Metro Mining (MMI:AU) has announced Appendix 4E

Download the PDF here.

Metro Mining (MMI:AU) has announced Appendix 4E

Metro Mining (MMI:AU) has announced Appendix 4E

Download the PDF here.

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall project

Download the PDF here.

ThreeD Capital Inc. (‘ThreeD’ or the ‘Company’) (CSE:IDK OTCQX:IDKFF) a Canadian-based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors, is excited to announce additional YouTube interviews with certain portfolio companies of ThreeD.

Already uploaded on ThreeD’s YouTube channel are several recent interviews with companies such as AI/ML Innovation Inc. (CSE: AIML), Neurable Inc., Hypercycle, and TODAQ Micro Inc,. to name a few.

In the coming weeks ThreeD plans to complete additional interviews with portfolio companies, including with Forte Minerals Corp. (‘Forte Minerals’) (CSE: CUAU,OTC:FOMNF). Forte Minerals is a Canadian exploration company with copper and gold assets in Peru. Forte Minerals recently provided updates on its operations referenced in its press release dated November 26, 2025 and its press release dated February 24, 2026.

The companies noted above do not represent all of ThreeD’s portfolio holdings. The holdings of securities of investees by ThreeD are managed for investment purposes. ThreeD could increase or decrease its investments in these companies at any time, or continue to maintain its current position, depending on market conditions or any other relevant factor.

About ThreeD Capital Inc.

ThreeD is a publicly-traded Canadian-based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors. ThreeD’s investment strategy is to invest in multiple private and public companies across a variety of sectors globally. ThreeD seeks to invest in early stage, promising companies where it may be the lead investor and can additionally provide investees with advisory services and access to the Company’s ecosystem.

| For further information: |

|

Jakson Inwentash |

| Vice President Investments |

| jinwentash@threedcap.com Phone: 416-941-8900 ext 107 |

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements. Often, but not always, these forward looking statements can be identified by the use of words such as ‘estimate’, ‘estimates’, ‘estimated’, ‘believes’, ‘hopes’, ‘potential’, ‘open’, ‘future’, ‘assumed’, ‘projected’, ‘used’, ‘detailed’, ‘has been’, ‘gain’, ‘upgraded’, ‘offset’, ‘limited’, ‘contained’, ‘reflecting’, ‘containing’, ‘remaining’, ‘to be’, ‘periodically’, or statements that events, ‘could’ or ‘should’ occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, risks relating to the prospectivity of the Company’s investments, determinations of the Company to increase or decrease its investment in any given investee from time to time, and such risks detailed from time to time in the Company’s filings with securities regulators and available under the Company’s profile on SEDAR at www.sedarplus.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

![]()

News Provided by GlobeNewswire via QuoteMedia

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern Nevada, approximately 40 kilometers southeast of Reno. The Company has three mineralized structures: The Comstock Lode, The Occidental/Brunswick Lode and The Silver City Spur. The Comstock Lode is an epithermal gold and silver deposit in a large fault system at the eastern base of the Virginia Range. The Occidental/Brunswick Lode is a gold and silver mineralized epithermal system in approximately 1.5 kilometers east of the main Comstock Lode and running parallel to it. The Silver City Spur is a branch of the Comstock Lode that runs southeast and connects with the southwestern splays of the Occidental Lode.

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern Nevada, approximately 40 kilometers southeast of Reno. The Company has three mineralized structures: The Comstock Lode, The Occidental/Brunswick Lode and The Silver City Spur. The Comstock Lode is an epithermal gold and silver deposit in a large fault system at the eastern base of the Virginia Range. The Occidental/Brunswick Lode is a gold and silver mineralized epithermal system in approximately 1.5 kilometers east of the main Comstock Lode and running parallel to it. The Silver City Spur is a branch of the Comstock Lode that runs southeast and connects with the southwestern splays of the Occidental Lode.

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.

China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring to materials with both civilian and military applications — to 20 Japanese companies, while placing another 20 groups on a new “watch list,” according to media reports.

Rare earth magnets are essential components in automobiles, electronics and defense systems, and global manufacturers remain heavily reliant on Chinese supply. The immediate export freeze applies to companies linked to defense-related work at Mitsubishi Heavy Industries (TSE:7011,OTCPL:MHVYF), Kawasaki Heavy Industries (TSE:7012,OTCPL:KWHIF), IHI (TSE:7013,OTCPL:IHICF) and NEC (TSE:6701,OTCPL:NIPNF).

Meanwhile, firms placed on the watch list will face slower shipments and must pledge “that the dual-use items will not be used for any purpose that contributes to enhancing Japan’s military capabilities.”

Items covered include critical minerals such as gallium, germanium, antimony and graphite, as well as rare earths, magnetic materials and certain advanced manufacturing equipment.

The dispute traces back to remarks in November last year by Prime Minister Sanae Takaichi, who said a hypothetical Chinese invasion of Taiwan could pose an “existential threat” to Japan and suggested Tokyo could respond with armed force. Beijing claims sovereignty over Taiwan and has warned it could use force if Taipei resists indefinitely.

The pressure also comes as Japan steps up efforts to reduce its dependence on China for rare earths. Earlier this month, Tokyo announced it had successfully retrieved mineral-rich seabed sediment from nearly 6,000 meters below the ocean near the remote island of Minamitorishima.

The material was recovered by the deep-sea drilling vessel Chikyu as part of a government-backed test program assessing the feasibility of mining rare-earths-bearing mud.

“It is a first step toward industrialization of domestically produced rare earth in Japan,” Takaichi said in a statement posted on X. “We will make efforts toward achieving resilient supply chains for rare earths and other critical minerals to avoid overdependence on a particular country.

China has used rare earths exports as leverage before.

In 2010, following a territorial dispute in the East China Sea, Beijing halted rare earths shipments to Japan, sending prices soaring and exposing Tokyo’s heavy reliance on Chinese supply.

The episode became a turning point for Japan’s resource strategy, accelerating efforts to diversify supply and directly supporting the rise of Australia’s Lynas Rare Earths (ASX:LYC,OTCQX:LYSDY), which has since grown into the largest rare earths producer outside China.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

“Copper Intelligence” (AFDG) “a dedicated copper exploration company, with a focus on creating value around Africa and DRC specifically focused on under-explored basins of copper ” (the “Company”) is pleased to announce that it has been invited to present on the Emerging Growth Conference for a business update on February 26, 2026 at 4.10pm EST, and invites individual and institutional investors as well as advisors and analysts, to attend its real-time, interactive presentation.

This live, interactive online event will give existing shareholders and the investment community the opportunity to interact with the Company’s Chairman, Andrew Groves as well as the Geological Director Aldo Cesano in real time.

Please register here to ensure you are able to attend the conference and receive any updates that are released.

https://goto.webcasts.com/starthere.jsp?ei=1717092&tp_key=1ddfafa563&sti=afdg

If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available on EmergingGrowth.com and on the Emerging Growth YouTube Channel, http://www.YouTube.com/EmergingGrowthConference. The company will release a link to that after the event.

About ‘ Copper Intelligence ‘

On Feb 4, 2026, African Discovery Group (AFDG), the predecessor company to Copper Intelligence, announced the signing of Definitive Sales and Purchase Agreement (SPA) for the Butembo Copper Asset in the Democratic Republic of Congo, in a Reverse Takeover Transaction (RTO), solidifying its status as the first stand-alone DRC company to be publicly traded in the United States. Butembo is a near surface, low strip, Tier one exploration opportunity, located near the Ruwenzori mountain location of Uganda’s biggest copper mine (Kilembe with 4 million tons of verified reserves), located only 50km from the Ugandan border with verified access to rail. The High-grade copper samples thus far have returned 18% Copper assays, which if maintained at production would rank amongst the highest globally. The recent discovery of the Butembo copper deposit has underscored the need for further exploration work in areas peripheral to the Katanga Copper Belt.

About the Emerging Growth Conference

The Emerging Growth conference is an effective way for public companies to present and communicate their new products, services and other major announcements to the investment community from the convenience of their office, in a time efficient manner. The Conference focus and coverage includes companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long term growth. Its audience includes potentially tens of thousands of Individual and Institutional investors, as well as Investment advisors and analysts. All sessions will be conducted through video webcasts and will take place in the Eastern time zone.

Disclosure:

This press release contains forward-looking statements. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to future exploration and production work in the Democratic Republic of Congo. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “forecasts,” “future,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements.

The company cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, and impacts, as well as those factors described in more detail under the heading “Risk Factors” in AFDG’s Annual Report on Form 10-K for the year ended February 28, 2026, to be filed with the U.S. Securities and Exchange Commission.

Investors are cautioned that many of the assumptions upon which AFDG’s forward-looking statements are based are likely to change after the date the forward-looking statements are made. Further, AFDG may make changes to its business plans that could affect its results. AFDG undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes.

Media Contact:

www.copperintelligence.com

Maxine Gordon

(917) 478-0406

Source

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.

The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of recent and ongoing drilling. This area forms the footprint of the planned Initial Mine, which is expected to be developed as an open pit.

Highlights

Charlie Long CEO commented:

“We are delivering strong, value-accretive progress at the Agadir Melloul and remain focused on advancing towards production as soon as practicable. The award of the Mining Licence is a major milestone and further underlines Morocco’s credentials as a supportive and attractive mining jurisdiction. I would like to thank our joint venture partner and the regional government for their continued support as we move into a busy and exciting period of delivery.”

|

Critical Mineral Resources plc Charles Long, Chief Executive Officer |

info@cmrplc.com |

|

Shard Capital LLP Erik Woolgar Damon Heath |

+44 (0) 207 186 9952 |

Notes To Editors

Critical Mineral Resources (CMR) PLC is an exploration and development company focused on developing assets that produce critical minerals for the global economy, including those essential for electrification and the clean energy revolution. Many of these commodities are widely recognised as being at the start of a supply and demand super cycle.

CMR is building a diversified portfolio of high-quality metals exploration and development projects in Morocco, focusing on copper, silver and potentially other critical minerals and metals. CMR identified Morocco as an ideal mining-friendly jurisdiction that meets its acquisition and operational criteria. The country is perfectly located to supply raw materials to Europe and possesses excellent prospective geology, good infrastructure and attractive permitting, tax and royalty conditions.

The Company is listed on the London Stock Exchange (CMRS.L). More information regarding the Company can be found at www.cmrplc.com

Source

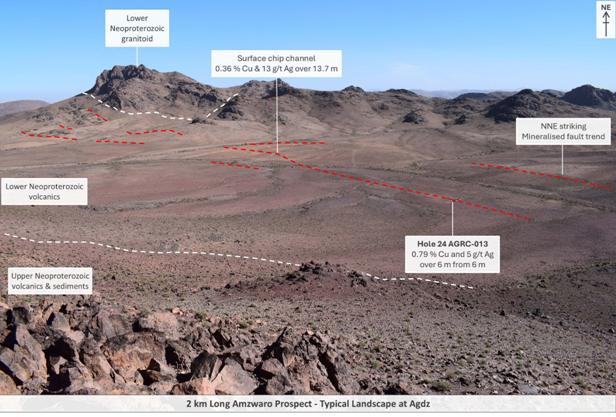

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it’s recently commissioned Environmental Impact Assessment (”EIA”) for the 100%-owned Agdz Mining Licence, part of the Agdz (‘Cu-Ag‘) Project (‘Agdz‘ or the ‘Project‘) in the Kingdom of Morocco (‘Morocco‘).

In the current global mining environment, the approval of the EIA represents a major regulatory milestone and materially de-risks the Project as Aterian advances toward systematic drilling and development readiness.

Highlights:

Charles Bray, Chairman of Aterian, commented:

‘Securing Moroccan EIA approval for the Agdz Mining Licence is a major step forward for Aterian. In a tightening global permitting environment, being regulatorily cleared to advance a copper project is a significant competitive advantage.

Our focus now shifts decisively to drilling for scale to develop this asset. The objective is clear: expand the mineralised footprint, build toward a defined resource base, and position Agdz as a development-ready copper asset in a jurisdiction with strong infrastructure and mining heritage. The integration of AI-driven geological modelling, through our partnership with Lithosquare, strengthens our targeting capability and enhances capital efficiency as we move into the next drilling phase.

With copper demand structurally rising and permitted projects increasingly scarce, Agdz represents a compelling opportunity. We are especially pleased to hear from existing shareholders seeking to participate in the recent equity placing, allowing the Company to allocate for expenditure to deliver sustained drilling news flow as we advance the Project over 2026.’

Strategic Importance

Permitted copper projects are increasingly scarce globally. With demand driven by electrification and the energy transition, projects capable of advancing without regulatory uncertainty are becoming strategically important.

EIA approval significantly strengthens Agdz’s development pathway and enhances its attractiveness to investors and potential strategic partners. The integration of AI-driven geological modelling through Lithosquare further positions Aterian to deploy capital efficiently and maximise discovery potential as drilling resumes.

Project Summary:

Aterian holds a 100% interest in the 50.4 km² Agdz Copper-Silver Project, comprising the 34.5 km² Agdz licence and the adjacent 15.9 km² Agdz Est licence in central Morocco.

The Project is located in the highly prospective Anti-Atlas Mountains within the Drâa Tafilalet region, approximately 35 km east of Ouarzazate, a well-serviced regional hub with an airport and established infrastructure. The Project benefits from excellent access via paved and unpaved roads. It is situated approximately 40 km southeast of the Noor solar power complex, one of the world’s largest renewable energy facilities.

Agdz is located within Morocco’s highly prospective Anti-Atlas belt, a stable and well-established mining jurisdiction with growing strategic importance for copper supply.

The Agdz Project is situated within a well-established copper-silver mining district, approximately 14 km southwest of the Bouskour copper-silver mine (19 Mt at 1.44 % Cu and 12 g/t Ag Measured & Indicated and 9 Mt at 1.61 % Cu Proven & Probable1) and within trucking distance of existing mining infrastructure. The world-class Imiter silver mine (192 M Oz Ag Measured & Indicated and 152 M Oz Ag Proven & Probable2) lies approximately 80 km northeast of the Project, with both operations owned by Managem Group. While mineralisation at neighbouring deposits is not necessarily indicative of mineralisation at Agdz, their presence underscores the district-scale prospectivity of the Anti-Atlas Belt.

1 Source: Managem Group – Bouskour project (managemgroup.com). May not be reported in accordance with compliant reporting requirements.

2 Source: Managem Group – Imiter mine (managemgroup.com). May not be reported in accordance with compliant reporting requirements.

|

|

Illustrations

The following figures/images have been prepared by Aterian and relate to the disclosures in this announcement.

Issue of Equity and Funding

The Company also announces, following on from the announcement dated 19 February 2026, that it has raised an additional £100,000 from existing investors through a subscription for 400,000 new ordinary shares (‘Subscription Shares‘) at a price of 25 pence per Subscription Share and the issue of an additional 112,000 shares to the Employee Benefit Trust (‘EBT Shares‘). Subscribers to the Subscription Shares will also receive 200,000 warrants (the ‘Warrants‘), or 50% warrant coverage, with each Warrant exercisable at a strike price of 32.5 pence per ordinary share. The Warrants will have a maturity date of 15 February 2028 and a call feature should the Company’s closing mid-price exceed 50 pence for three consecutive trading days. A further total of 88,000 new ordinary shares have been issued in lieu of fees to a service provider (‘Fee Shares‘).

An application will be made for the Subscription Shares, the EBT Shares and the Fee Shares (together the ‘New Shares‘) to be admitted to trading on the London Stock Exchange, with admission expected to occur on or around 03 March 2026 (‘Admission‘). Following the issue of the New Shares, the Company’s enlarged issued share capital will comprise 17,684,000 Ordinary Shares.

This figure of 17,684,000 represents the total voting rights in the Company and should be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in the Company under the Financial Conduct Authority’s Disclosure Guidance & Transparency Rules.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Simon Rollason, Chief Executive Officer of Aterian Plc. A graduate of the University of the Witwatersrand in Geology (Hons). He is a Member of the Institute of Materials, Minerals and Mining, with over 30 years of experience in mineral exploration and mining.

– ENDS –

This announcement contains information which, prior to its disclosure, was inside information as stipulated under Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310 (as amended).

Engage directly with the Aterian PLC management team by asking questions, watching video summaries, and seeing what other shareholders have to say. Please navigate to our interactive investor hub here: https://aterianplc.com/s/fcf8eb

For further information, please visit the Company’s website: www.aterianplc.com or contact:

Aterian Plc:

Charles Bray, Executive Chairman – charles.bray@aterianplc.com

Simon Rollason, CEO & Director – simon.rollason@aterianplc.com

Financial Adviser and Joint Broker:

AlbR Capital Limited

David Coffman / Dan Harris

Tel: +44 (0)207 7469 0930

Joint Broker:

SP Angel Corporate Finance LLP

Ewan Leggat / Devik Mehta

Tel: +44 20 3470 0470

Financial PR:

Bald Voodoo – ben@baldvoodoo.com

Ben Kilbey

Tel: +44 (0)7811 209 344

Subscribe to our news alert service: https://atn-l.investorhub.com/auth/signup

Notes to Editors:

About Aterian plc

www.aterianplc.com

Aterian plc is an LSE-listed exploration and development company with a diversified African portfolio of critical metals projects.

Aterian plc is actively seeking to acquire and develop new critical metal resources to strengthen its existing asset base while supporting ethical and sustainable supply chains as the world transitions to a sustainable, renewable future. The supply of these metals is vital for developing the renewable energy, automotive, and electronic manufacturing sectors, which are increasingly important in reducing carbon emissions and meeting global climate ambitions.

Aterian has a portfolio of multiple copper-silver (+gold) and base-metal projects in Morocco. Aterian holds a 90% interest in Atlantis Metals, a private Botswana-registered company holding eleven mineral prospecting licences for copper-silver in the world-renowned Kalahari Copperbelt and three for lithium and salt brine exploration in the Makgadikgadi Pans region. The Company also holds an exploration licence in southern Rwanda, where it is evaluating the tantalum and niobium opportunity, in addition to further exploring for pegmatite-hosted lithium.

The Company’s strategy is to seek new exploration and production opportunities across the African continent and to develop new sources of critical mineral assets for exploration, development, and trading.

Glossary of Terms

The following is a glossary of technical terms:

|

‘Ag’ |

means |

Silver |

|

‘Au’ |

means |

Gold |

|

‘Breccia’ |

means |

a rock consisting of angular fragments of stones cemented by finer materials |

|

‘Cu’ |

means |

Copper |

|

‘Ferruginous’ |

means |

containing iron oxides |

|

‘Float sample’ |

means |

loose pieces of rock that are not connected to an outcrop |

|

‘g/t’ |

means |

grams per tonne |

|

‘Hercynian or Variscan Orogeny’ |

means |

an orogenic belt that evolved during the Devonian and Carboniferous periods, from about 419 to 299 million years ago |

|

‘km’ |

means |

Kilometres |

|

‘m’ |

means |

Metres |

|

‘mm’ |

means |

Millimetres |

|

‘Mt’ |

means |

millions of tonnes |

|

‘NI 43-01’ |

means |

National Instrument 43-101 Standards of Disclosure of Mineral Projects of the Canadian Securities Administrators |

|

‘Outcrop’ |

means |

a rock formation that is in situ and visible on the surface |

|

‘Qualified Person’ |

means |

a person that has the education, skills and professional credentials to act as a qualified person under NI 43-101 |

|

‘Sb’ |

means |

Antimony is used in alloys and in lead-acid storage batteries. The U.S. government has considered antimony a critical mineral mainly because of its use in military applications. |

|

‘Stratiform’ |

means |

parallel to the bedding planes of the surrounding rock |

|

‘Vein’ |

means |

a distinct sheetlike body of crystallised minerals within a rock |

|

‘Zn’ |

means |

Zinc |

Source

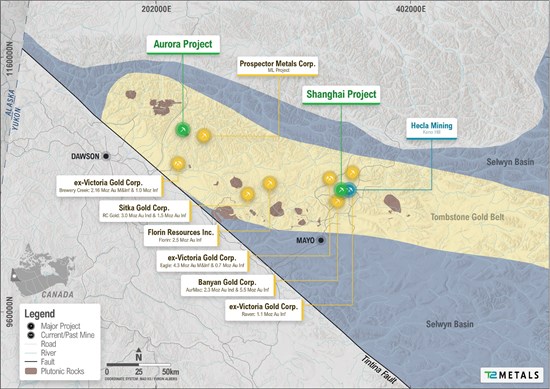

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) (‘T2 Metals’ or the ‘Company’) is pleased to announce signing of an Option Agreement (the ‘Option’) with renowned explorer Shawn Ryan (‘Ryan’) and Wildwood Exploration Inc. (together with Ryan, the ‘Optionor’) to earn a 100% interest in the 76 sq km Aurora Gold Project in prolific Tintina Gold Belt of the Yukon Territory, Canada.

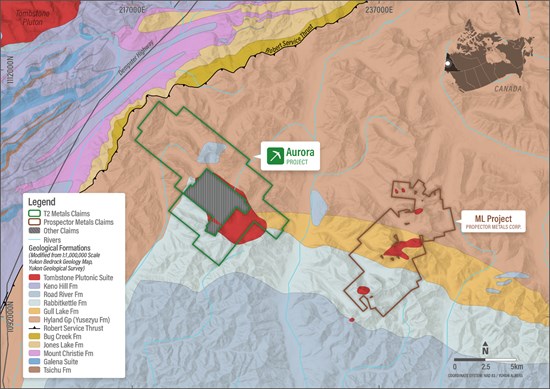

Aurora is an Intrusion Related Gold System (‘IRGS’) that lies 70 km northeast of Dawson City, is 2 km from the Dempster Hwy at its nearest point, and importantly only 10 km east of Prospector Metals Corp’s ML Project (see Figure 1).

Project Highlights:

Mark Saxon, CEO of T2 Metals Corp., said, ‘The acquisition of the Aurora Gold Project reinforces T2 Metals very strong entry into in the Yukon, built upon foundations laid by explorers Shawn Ryan and Cathy Wood over decades of exploration. Aurora is a well mineralized yet lightly explored mineral project that lies along strike from Prospector Metals’ new ML discovery. They have held the Aurora ground since 2004 and are very pleased to be entrusted with the ongoing exploration of this exciting property.’

Project partner, Shawn Ryan, commented, ‘Aurora is one of the highest prospectivity mineral projects I’ve held in the Yukon, and the nearby success of Prospector Metals reinforces its potential. I’m excited to be working with the T2 Metals technical team to see how this project develops.’

Figure 1: Regional Location of the Aurora Mineral Project, Yukon Territory, Canada.

See Table 2 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_002full.jpg

Exploration History

Exploration at Aurora has been intermittent since the first discovery of stibnite veins in 1916, which provided the early name for the area, Antimony Mountain. Notable work programs were conducted by Conwest Exploration (1966-1967), Anaconda Canada (1979-1980), Total Energold (1988-1989), and Kennecott (1994-1998).

More recently, Logan Resources and Golden Predator conducted soil sampling surveys and limited diamond drilling (2005-2011), intersecting significant gold mineralization and defining further high-grade targets at the AJ Vein and Golden Wall prospects (see Table 1 or https://data.geology.gov.yk.ca/Occurrence/14772#InfoTab).

Regional Geology

The Aurora Gold Project lies near the western edge of the Selwyn Basin in the northwest of the Yukon Territory. The stratigraphy consists of late Proterozoic to Palaeozoic marginal basinal and platformal clastic and pelitic sediments, intruded by post-accretionary mid-Cretaceous plutons. The Tombstone Plutonic Suite (93-91 Ma) are represented by alkalic monzonites and syenites often associated with intrusion-related gold deposits, most often exposed in the western part of the Selwyn Basin, close to the Tintina Fault (Stephens et al., 2004; Colpron et al., 2011).

Table 1. Aurora Gold Project history, taken from Yukon Geological Survey records.

| Company | Date(s) | Work Performed | Significant Mineralization Noted |

| Mr. W Walker | 1916-1918 | 5.5 m adit and hand trenching in stibnite veins in an aplite dyke. | Sb |

| Conwest Exploration & Central Patricia Gold Mines | 1966-1967 | Staking, geochem, geophysics, mapping, and 4 drill holes (200.9m). | Au: Up to 120.0 g/t over 1.3m (North showing); 28.5 g/t over 2.8m in drilling. |

| Cream Silver Mines | 1970 | Geological mapping and hand trenching of Rainbow and JC veins | N/A |

| Acheron Mines (later Pan Acheron Resources) | 1975-1976 | Mapping, geochem, hand trenching, and 3 drill holes (166.1m). | Au: 20.6 g/t over 3.1m (South showing vein) in drilling. |

| Standard Oil Company | 1975-1976 | Airborne radiometric survey, stream sediment survey over Antimony Mtn stock; ground radiometrics. | N/A |

| Anaconda Exploration Ltd | 1979-1980 | Mapping and geochemical sampling, 4 DDH totalling 1000 m in the Rainbow and JC veins. | N/A |

| Riocanex Inc. | 1980 | Electromagnetic (EM) survey. | N/A |

| Cody Hawk Resources | 1982-1988 | Mapping, EM surveys, rock sampling, and trenching. | Au: Identified association with quartz-tourmaline-sulphide veins in hornfels. |

| Total Energold Corp | 1988-1989 | Mapping, geochem, airborne/surface geophysics, trenching, 6 drill holes (756m). | Au: 22.8 g/t over 1.53m; 7.9 g/t and 7.5 g/t over 1.8m in drilling. |

| Kennecott Canada Inc. | 1994-1998 | Large-scale mapping, soil/stream/rock sampling, and prospecting. | Au: Float samples of 19.0 g/t and 7.24 g/t; 69.0 g/t Au from Toby Creek vein outcrop. |

| Prospector International Resources | 1997-1998 | Staking, stream sampling, and prospecting. | Ag/Pb/Zn: 15.6 ppm Ag, 1.3% Pb, and 6.5% Zn (For Sure claims). |

| Strategic Metals / War Eagle JV | 2004 | Prospecting, soil sampling, mapping, trenching, and 4 drill holes (832m). | Au/Cu: 20-40m intervals of 200-300 ppb Au; associated with chalcopyrite (Cu). |

| Logan Resources / Golden Predator | 2005-2011 | 12 diamond drill holes on the AJ target. | Au: 12.45 g/t over 4.88m; 5.55 g/t over 0.49m; 9.24 g/t over 0.31m. |

Property Geology

The Aurora Project is underlain by Late Proterozoic to Lower Cambrian clastic metasediments of the Hyland Group (Yusezyu and Narchilla Formations) which consist of interbedded shale, quartzite, and coarse sandstone. These are transitionally overlain by the Road River Group, comprised of calcareous greywacke, siltstone, and limestone (see Figure 2).

The central part of the project is underlain by the Mid-Cretaceous (93-91 Ma) Antimony Mountain Stock (AMS), part of the Tombstone Plutonic Suite. The stock is an elongate, 7 x 3.5 km body of hornblende syenite to quartz monzonite. It exhibits a porphyritic texture with alkali feldspar phenocrysts and is fringed by a fine-grained diorite phase. Notably, the northern part of the stock is essentially non-magnetic (reduced), while the southern portion is highly magnetic (oxidized), suggesting multiple intrusive pulses.

Aurora is strategically located between the Tintina Fault to the south and the Dawson Thrust Fault to the north, with the Robert Service Thrust situated on the western edge of the property. This regional-scale fault network has provided access for hydrothermal fluids associated with the younger Tombstone-age intrusions.

The property is characterized by isoclinal folding and east-west trending faults that act as local conduits for precious and base metal mineralizing fluids. A massive hornfels aureole extends up to 1 km from the Antimony Mountain Stock margins, where sedimentary rocks are intensely silicified and include finely disseminated pyrrhotite and pyrite, creating prominent iron oxide (limonite, goethite) stained rusty ridges. Skarn/calc-silicate replacement alteration (diopside-epidote-actinolite) is locally developed where the intrusion contacts limey sediments.

Figure 2: Regional Geological Map for Aurora Project, Yukon Territory, Canada.

See Table 1 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_003full.jpg

Mineralization

The Aurora Gold Project is located 10 km west of Prospector Metals Corp’s ML Project, in the heart of the Tombstone Gold Belt, a region renowned for large-scale Intrusion Related Gold Systems. Much like the ML Project, Aurora overlies and is adjacent to a Tombstone-age intrusion that remains significantly underexplored despite high-grade historical drilling intersections. Both properties demonstrate precious and base metal mineralization with potential for bulk-tonnage porphyry Au-Cu, high-grade Au sheeted veins, and skarn replacement mineralization. The exploration success at the ML Project, characterized by its high-grade copper-gold intersections, provides a compelling geological analogue for the untapped potential at T2 Metals’ Aurora Project.

Six significant gold-bearing prospects have been identified at Aurora by past explorers over a 10 km trend utilizing soil and rock chip sampling (see Figure 3). High-grade quartz-arsenopyrite-tourmaline veins are commonly mapped in fault controlled east-trending orientations. The AJ Vein is the most significant vein mapped to date, traced for over 700 m, with historical intercepts of 28.5 g/t Au over 2.74 m. Other known veins include the JC, Rainbow, TK, and TT showings. The Golden Wall prospect displays stratabound disseminated sulphide (arsenopyrite-pyrite-pyrrhotite) in calcareous siltstones and quartzites with potential for bulk-tonnage porphyry-style mineralization within the AMS and broad stockwork zones within the contact metamorphic halo.

Figure 3: Local Geological Map for Aurora Project, Yukon Territory, Canada Including Know Gold Prospects.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7326/285388_f4b9e3b9c4e0db63_004full.jpg

Next Steps

T2 Metals is now integrating all historical geophysical and geochemical data to refine targets for a comprehensive diamond drilling program. Focus will be placed on the Golden Wall prospect which remains untested, expanding the known mineralization at the AJ Vein, and testing other undrilled gold-bearing prospects.

Option Terms

Subject to receipt of TSX Venture Exchange (‘TSXV’) approval of the Option Agreement, T2 Metals will have the option to acquire a 100% undivided interest in the Aurora mineral project, for a total consideration of $850,000 in cash and 3,500,000 common shares of T2 Metals to be paid to the Optionor in incremental amounts over a seven-year period, which may be accelerated at the discretion of T2 Metals. An initial cash payment of $75,000 and an initial payment of 400,000 common shares in T2 Metals will be made following TSXV acceptance of the Transaction. All shares issued under the Option Agreement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

In order to exercise the Option, T2 Metals is also required to incur exploration expenditures on the Aurora mineral project totalling a minimum of $2,500,000 over eight years, including $100,000 by November 15, 2026. On completion of an NI 43-101 compliant Feasibility Study, $1 per Indicated and Measured resource estimate ounces of gold will be payable to the Optionor. Upon commencement of commercial production on the Aurora mineral project, the Optionor will retain a 2.5% net smelter return royalty on the property with 1% purchasable by T2 Metals for the cash payment of $2,000,000 to the Optionor.

Furthermore, the Company will pay a 5% finder’s fee to an arm’s-length party in consideration for their efforts in introducing the Company to the Aurora opportunity. The finders fee will be paid on the equivalent schedule as payments to the Optionor and is in accordance with the policies of the TSX Venture Exchange.

The mineral claims are located principally within the traditional territory of the Trʼondëk Hwëchʼin First Nation, which has settled its land claim, and is a self-governing first nation.

About Shawn Ryan

Shawn Ryan is a well-known prospector and entrepreneur in the Yukon’s mineral exploration industry and sits on T2 Metals Advisory Board. He is recognized for his innovative and systematic approach to gold exploration, which has been credited with sparking a ‘second Klondike gold rush.’ Mr. Ryan’s career is marked by a methodical approach to sampling, including development of a novel auger soil sampling technique, a method particularly effective in the Yukon where thick soil layers often obscure bedrock.

Shawn Ryan’s work has led to several significant discoveries including the Golden Saddle and Arc deposits, which became part of the multi-million ounce White Gold Project acquired by Kinross Gold; and the Coffee project, which was sold to Goldcorp (now Newmont Corporation) for $520 million and is now being advanced to production by Fuerte Metals Corp. His contributions to the industry have earned him numerous awards, including the Bill Dennis Award for prospecting from the Prospectors & Developers Association of Canada (PDAC). Shawn’s work is seen as a major factor in modernizing exploration in the Yukon and drawing new attention to the territory’s mineral potential.

Table 1: Gold Deposits in the Tombstone Gold Belt with NI43-101 References

| Project | EFFECTIVE DATE | Author | Report For | Tonnes (M) | Au (g/t) | Contained Gold | Status |

| Brewery Creek | 18/01/2022 | Cook. C. et al., 2022. | Sabre Gold Mines Corp | 34.5 | 1.03 | 1.142 M oz | Measured & Indicated |

| 36.0 | 0.88 | 1.018 M oz | Inferred | ||||

| Report Title: Preliminary Economic Assessment. NI 43-101 Technical Report on the Brewery Creek Project Yukon Territory, Canada | |||||||

| Eagle (Dublin Gulch) | 31/12/2022 | Harvey, N., 2022 | Victoria Gold Corp |

233.2 | 0.57 | 4.303 M oz | Measured & Indicated |

| 36.2 | 0.62 | 0.724 M oz | Inferred | ||||

| Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada | |||||||

| Olive (Dublin Gulch) | 31/12/2022 | Harvey, N., 2022 | Victoria Gold Corp |

11.6 | 0.97 | 0.361 M oz | Measured & Indicated |

| 5.5 | 1.17 | 206,479 | Inferred | ||||

| Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada | |||||||

| Raven (Dublin Gulch) | 15/09/2022 | Jutras, M., 2022. | Victoria Gold Corp |

19.9 | 1.67 | 1.071 M oz | Inferred |

| Report Title: Technical Report On The Raven Mineral Deposit, Mayo Mining District Yukon Territory, Canada | |||||||

| Blackjack (RC Gold) | 21/01/2025 | Simpson. R., 2025 | Sitka Gold Corp |

39.9 | 1.01 | 1.298 M oz | Indicated |

| 34.6 | 0.94 | 1.045 M oz | Inferred | ||||

| Report Title: Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory | |||||||

| Eiger (RC Gold) | 19/01/2023 | Simpson. R., 2025 | Sitka Gold Corp |

27.4 | 0.5 | 0.440 M oz | Inferred |

| Report Title: Clear Creek Property, RC Gold Project. NI 43-101 Technical Report. Dawson Mining District, Yukon Territory | |||||||

| Airstrip (AurMac) | 28/06/2025 | Jutras, M., 2025 | Banyan Gold Corp |

27.7 | 0.69 | 0.614 M oz | Indicated |

| 10.1 | 0.75 | 0.244 M oz | Inferred | ||||

| Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada | |||||||

| Powerline (AurMac) | 28/06/2025 | Jutras, M., 2025 | Banyan Gold Corp |

84.8 | 0.61 | 1.663 M oz | Indicated |

| 270.4 | 0.60 | 5.216 M oz | Inferred | ||||

| Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada | |||||||

| Florin | 6/04/2025 | Simpson. R., 2021 | St. James Gold Corp |

170.9 | 0.45 | 2.474 M oz | Inferred |

| Report Title: Florin Gold Project. NI 43-101 Technical Report. Mayo and Dawson Mining Districts, Yukon Territory | |||||||

| Valley (Rouge) | 15/05/2025 | Burrell. H. et al., 2024 | Snowline Gold Corp |

75.8 | 1.66 | 4,047 M oz | Indicated |

| 81.0 | 1.25 | 3.256 M oz | Inferred | ||||

| Report Title: Rogue Project. NI 43-101 Technical Report and Mineral Resource Estimate. Yukon Territory, Canada |

About the Tombstone Gold Belt

The Tombstone Gold Belt, a component of the larger Tintina Gold Province, is a highly prospective metallogenic province in the Yukon, with a range of well-known and emerging gold discoveries. The belt is characterized by a suite of mid-Cretaceous, reduced, felsic intrusions known as the Tombstone Plutonic Suite. These intrusive bodies and the surrounding host rocks have created conditions for the formation of numerous Intrusion-Related Gold Systems (IRGS). Exploration efforts have identified multiple mineralized corridors with gold hosted in sheeted quartz veins and disseminated mineralization within both the intrusive bodies and the hornfelsed country rocks.

Gold mineralization in the Tombstone Gold Belt is typically associated with a distinctive multi-element signature that includes bismuth, tellurium, and tungsten, along with arsenic and antimony. Gold-bearing fluids exsolved from cooling intrusions and preferentially deposited gold in brittle, structurally controlled environments. Both high-grade, structurally-controlled vein systems and lower-grade, bulk-tonnage deposits are known. The region hosts numerous significant deposits and is the site of recent discoveries by companies such as Snowline Gold Corp., Banyan Gold Corp., Sitka Gold Corp. and Prospector Metals Corp.

Disclaimers

The qualified person (as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects) for the Company’s projects, Mr. Mark Saxon, the Company’s Chief Executive Officer, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists, has reviewed and approved the contents of this release.

Readers are cautioned that the discussion about adjacent or similar properties in this press release is not necessarily indicative of the mineralization or potential of the Aurora property. The Company has no interest in or right to acquire any interest in any such adjacent properties.

About T2 Metals Corp (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD)

T2 Metals Corp is an emerging copper and precious metal company enhancing shareholder value through exploration and discovery. T2 Metals is committed to engage with rights holders and stakeholders with the highest level of respect, ensuring that our exploration activities contribute positively to the communities in which we operate.

ON BEHALF OF THE BOARD,

| ‘Mark Saxon’

Mark Saxon President & CEO |

For further information, please contact: t2metals.com 1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

References:

Colpron, M. and Nelson, J.L., 2011. A Palaeozoic NW Passage and the Timanian, Caledonian and Uralian connections of some exotic terranes in the North American Cordillera.

Stephens, J.R., Mair, J.L., Oliver, N.H., Hart, C.J. and Baker, T., 2004. Structural and mechanical controls on intrusion-related deposits of the Tombstone Gold Belt, Yukon, Canada, with comparisons to other vein-hosted ore-deposit types. Journal of structural geology, 26(6-7), pp.1025-1041.

Cautionary Note Regarding Forward-Looking Statements

Certain information set out in this news release constitutes forward-looking information. Forward-looking statements are often, but not always, identified by the use of words such as ‘seek’, ‘anticipate’, ‘plan’, ‘continue’, ‘estimate’, ‘expect’, ‘may’, ‘will’, ‘intend’, ‘could’, ‘might’, ‘should’, ‘believe’ and similar expressions. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Although the Company believes that the expectations reflected in forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. Such risks include uncertainties relating to exploration activities. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

Source

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.

Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension takes effect immediately and will remain in place until further notice.

“Government expects cooperation of the mining industry on this measure which has been taken in the national interest,” the ministry said in a statement.

It added that authorities remain committed to “ensuring transparency, in-country value addition and beneficiation, compliance, and accountability in the exportation of Zimbabwe’s mineral resources.”

The abrupt move accelerates earlier plans to curb lithium concentrate exports. Harare had previously set January 2027 as the deadline for banning such shipments, aiming to push miners to establish local processing and refining capacity. Wednesday’s announcement effectively brings that timeline forward.

In a February 17 letter to the Chamber of Mines of Zimbabwe seen by Reuters, the ministry said it would realign export processes amid concerns about “continued malpractices during the exportation of minerals.”

The letter described the review as “part of a broader effort to curb leakages and enhance efficiency within our systems.”

Kambamura told reporters in Harare that the ban would only be lifted if miners comply with government requirements. He said Zimbabwe “will be engaging the industry in the near future on new expectations and way forward.”

Zimbabwe has rapidly emerged as a major supplier of lithium concentrate to China, where the material is refined into battery-grade products used in electric vehicles and energy storage systems.

The country exported 1.128 million metric tons of lithium-bearing spodumene concentrate by the end of 2025, up 11 percent from the previous year. It also holds Africa’s largest lithium reserves and ranks among the top global producers, with resources estimated at 126 million metric tons, according to official data.

Much of the sector’s recent growth has been driven by Chinese investment, with companies committing billions of dollars to develop Zimbabwean mines.

Lithium, along with rare earths and other strategic materials, have gained strategic priority for its role in producing batteries, electronics, renewable energy systems, and defense technologies.

Mining is Zimbabwe’s second-largest contributor to gross domestic product after manufacturing, accounting for 14.3 percent of output, according to World Bank data.

The immediate suspension, however, introduces uncertainty for producers and exporters who had been preparing for a phased transition.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.