(TheNewswire)

Prismo’s Interest Currently Stands at 95% With Option for Full Control

Vancouver, British Columbia, January 16th, 2025 TheNewswire – Prismo Metals Inc. (‘Prismo’ or the ‘Company’) (CSE: PRIZ,OTC:PMOMF) (OTCQB: PMOMF) is pleased to announce that it has completed its previously announced transaction with Infinitum Copper Corp. (TSXV: INFI) (‘Infinitum’) whereby Prismo has increased its interest in the Hot Breccia copper project, located in the heart of Arizona’s prolific copper belt, from 75% to 95%. In addition, Prismo has obtained an irrevocable option to acquire Infinitum’s remaining 5% interest, providing a clear path to 100% interest in the project.

Alain Lambert, CEO of Prismo commented: ‘This transaction marks a significant milestone for Prismo and provides a clear mechanism to securing full ownership of Hot Breccia. It materially improves the strategic flexibility of the project.’

He added: ‘Prismo remains firmly committed to advancing Hot Breccia. The recent extension of certain milestone obligations under the option agreement with Walnut Mines LLC, the owner of the Hot Breccia claims, together with the completion of the transaction with Infinitum, provides the Company with additional flexibility as we evaluate a range of strategic alternatives. Each of these pathways’ goal is to drill what we consider to be one of the most compelling copper exploration opportunities in Arizona and the broader United States.‘

Dr. Linus Keating, manager of Walnut Mines LLC, enthusiastically commented: ‘Walnut Mines is solidly in favor of any action that moves Hot Breccia closer to a serious drill program. We are hopeful that this transaction will accomplish that goal in 2026. In our opinion, this property remains one of the best copper exploration opportunities in North America.’

Under the terms of the transaction, Prismo paid Infinitum CA $185,000 to acquire a 20% additional interest in the Hot Breccia project and assumed all of Infinitum’s remaining obligations under the existing option agreement with Walnut to issue shares to Walnut, which has been satisfied by the issuance to Walnut of 450,630 common shares at a deemed issue price of $0.11 per share. Prismo has also agreed to pay Infinitum 5% of any consideration received in connection with a transaction in which Prismo assigns its interest in Hot Breccia to a third party to acquire the 5% interest held by Infinitum.

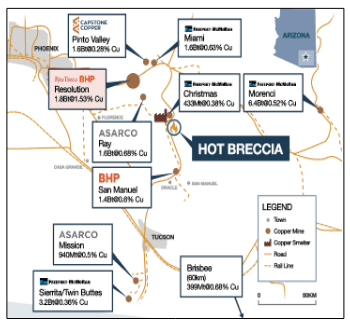

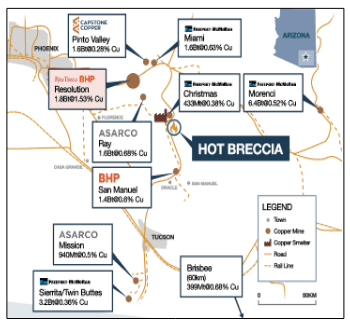

Prismo‘s Hot Breccia project lies at the heart of the Arizona Copper Belt, which hosts several globally significant porphyry copper deposits. Examples of these significant deposits are Freeport McMoRan’s Miami-Inspiration mining complex, BHP’s San Manuel mine, Rio Tinto and BHP’s Resolution deposit and others (see Figure 1).

Figure 1. Location of the Hot Breccia Project in the Arizona Copper Belt.

The Company wishes to update its January 12th, 2026 news release to confirm that the Company issued 2,250,000 units for gross proceeds of $225,000 and issued 140,000 Finder’s Warrants and paid finder’s commissions of $14,000 to a certain qualified finder. Each Unit consisted of one common share in the capital of the Company (a ‘Share‘) and one common share purchase warrant of the Company (a ‘Warrant‘). Each Warrant entitles the holder to purchase one Share for a period of thirty-six (36) months from the date of issue at an exercise price of $0.175. Prismo intends to proceed next week a final closing of 1,500,000 Units for gross proceeds of $150,000.

About Prismo Metals Inc.

Prismo (CSE: PRIZ,OTC:PMOMF) is a mining exploration company focused on advancing its Hot Breccia copper project in Arizona and its Palos Verdes silver project in Mexico.

Please follow @PrismoMetals on , , , Instagram, and

Prismo Metals Inc.

1100 – 1111 Melville St., Vancouver, British Columbia V6E 3V6 Phone: (416) 361-0737

Contact:

Alain Lambert, Chief Executive Officer alain.lambert@prismometals.com

Gordon Aldcorn, President gordon.aldcorn@prismometals.com

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as ‘intends‘ or ‘anticipates‘, or variations of such words and phrases or statements that certain actions, events or results ‘may’, ‘could‘, ‘should‘, ‘would‘ or ‘occur‘. This information and these statements, referred to herein as ‘forward‐looking statements’, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions with respect to, among other things: the timing, costs and anticipated results of drilling at Hot Breccia; the ability of Prismo to fund drilling and pursue potential third-party partnerships; the Company’s strategic flexibility with respect to the Hot Breccia project going forward; the number of shares issuable by Prismo to Walnut pursuant to the transaction described in this news release; and the Company’s expectations regarding mineralization and other qualities of the Hot Breccia project.

These forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain appropriate funding to finance the exploration program at Hot Breccia; the risk that the Company will not enter into a third-party partnership with respect to the Hot Breccia project; the risk that mineralization will not be as anticipated at the project; the risk that the Company will not be able to take advantage of geological information to refine drill targeting; metal prices; market uncertainty; and other risks and uncertainties application to exploration activities and the Company’s business as set forth in the Company’s disclosure documents available for viewing under the Company’s profile on SEDAR+ at www.sedarplus.com.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the ability to raise capital to fund the drilling campaign at Hot Breccia and the timing of such drilling campaign; the ability of the Company to enter into a third-party partnership on the project; that the project will have the anticipated mineralization and other qualities; and the Company will be able to take advantage of geological information to refine drill targeting.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

Copyright (c) 2026 TheNewswire – All rights reserved.

Dalaroo Metals Ltd (ASX: DAL, “Dalaroo” or “Company”) is pleased to announce the results of its 2025 exploration program completed at the Company’s 100%-owned Blue Lagoon Project in Greenland (Figure 1).

Dalaroo Metals Ltd (ASX: DAL, “Dalaroo” or “Company”) is pleased to announce the results of its 2025 exploration program completed at the Company’s 100%-owned Blue Lagoon Project in Greenland (Figure 1).